A trend is emerging in legal marijuana markets. Consumers are buying more marijuana edibles and extracts than ever before. 2017 revenue from raw flower fell below 50% of sales in all legal US states for the first time. Consumers are happy to pay $5 or even $10 for a brownie or candy bar that offers them a healthier alternative to smoking. What they might not know is how happy the switch to edibles is making the marijuana industry.

The transition from smokable marijuana to edible extracts is a best-case scenario for the legal producers. Edibles command much higher margins and prices than dry marijuana, allowing producers to maintain their revenue per gram even if wholesale flower prices fall due to supply exceeding demand.

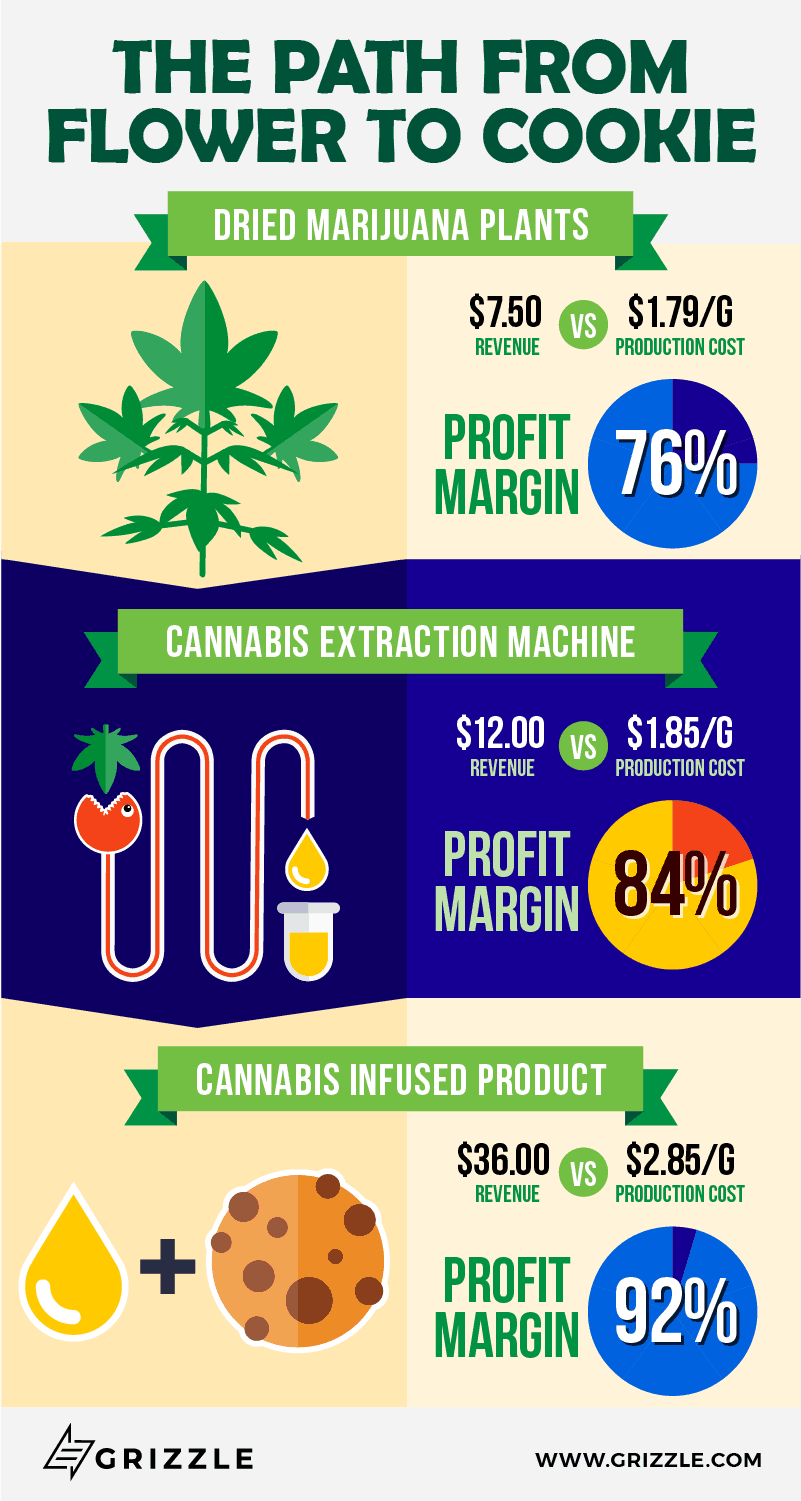

We will take you through the three steps from flower to oil to cookie and the profitability of each to demonstrate the huge revenue potential for producers as sales transition from flower to extracts.

But First…

Q: What does dried gram equivalent mean?

A: A dry gram equivalent is the amount of product you end up with after processing one gram of dried marijuana flower into oil or edibles.

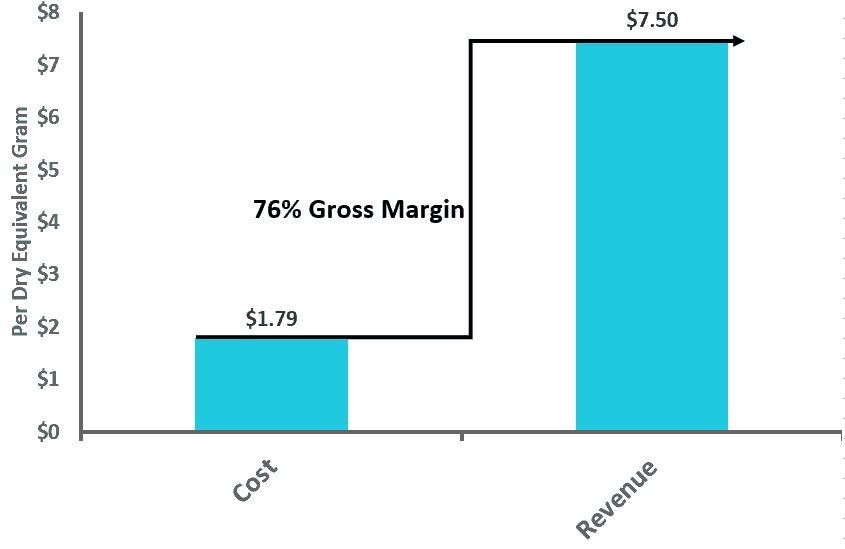

Step 1: Dried Marijuana Flower ($7.50 per dry gram)

In its most basic form dried marijuana flower sold for $7.50 per gram in 2017 according to government data. Prices vary wildly based on potency and branding with some medical strains going for upwards of $12.00 per gram. As the market matures customers will have multiple options to choose from, increasing competition and compressing price differences between brands. The cost to sell dried flower includes the cost of regulatory testing required to make sure there are no traces of mildew, pests or pesticides.

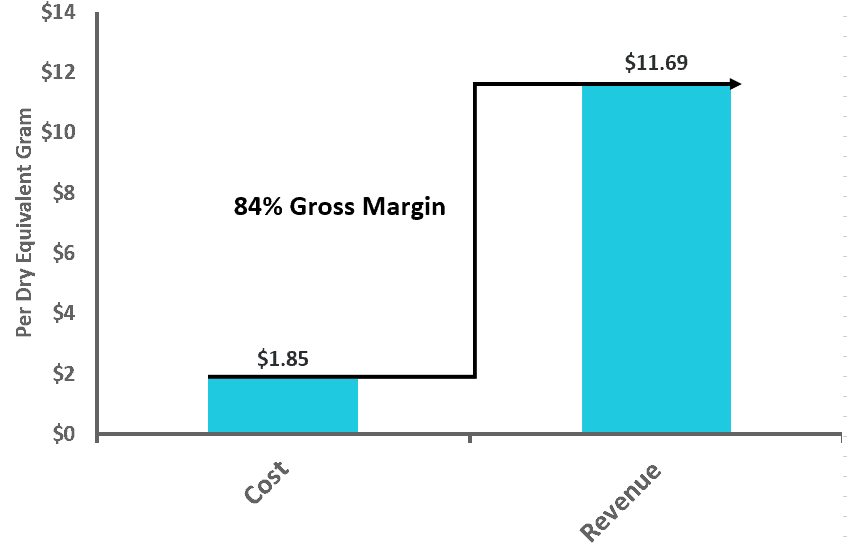

Step 2: Marijuana Extract ($12 per dry gram equivalent)

Producers grind up raw flower and load it into high-pressure extraction machines that pull out only active ingredients from the flower. Marijuana plants vary from 5-25% THC so the amount of active ingredient remaining after processing will vary. For our estimates we assume 15% THC content flower is used as the raw ingredient and a 70% yield of the original THC is achieved after processing.

High quality marijuana oil sells for ~$12 per dry gram equivalent which is much better than raw flower. The cost per gram to extract active ingredients from dried marijuana is only an additional $0.05 per gram at scale leading to gross margins of 84% compared to 76% for flower, well worth the extra expense.

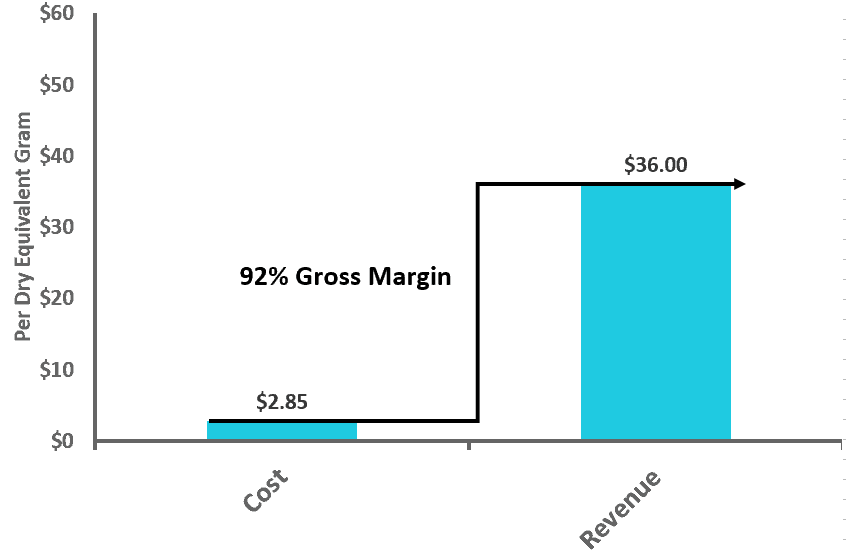

Step 3: Marijuana Edibles ($36 per dry gram equivalent)

Now here is where the big money is. Edibles can take the form of candies, cookies, chocolates, sprays, or even pills. Prices per dry gram vary but are often in the range of $20-$50 ($36 on average). Edible prices generate extremely attractive margins at almost 92%. Vertical integration, including growing, processes and manufacturing, is required to recognize margins this high.

What Does the Transition to Extracts Mean for the Industry?

The main way to avoid a steep fall in price is to provide value added products to consumers so they feel justified in paying a premium. An example of adding value would be to sell pills to consumers who don’t want to smoke and are on the go, or edibles for consumers who want a treat but also want to enjoy the effects THC and CBD provide.

Any marginally sophisticated legal producer is well aware that the margins on extracts are eye opening. For $50 of raw material and another $1,700 for equipment, a producer can grow enough marijuana to produce $40,000 of revenue, truly incredible. The industry is quickly building processing capacity to supply extract demand and is benefiting from consumers preference for ingestible marijuana.

The legal producer that wins will be the first to become a large-scale extraction supplier and the one that is vertically integrated and can take the marijuana from seed to flower to oil to cookie.

Top 3 Ways to Play the Marijuana Extract Trend

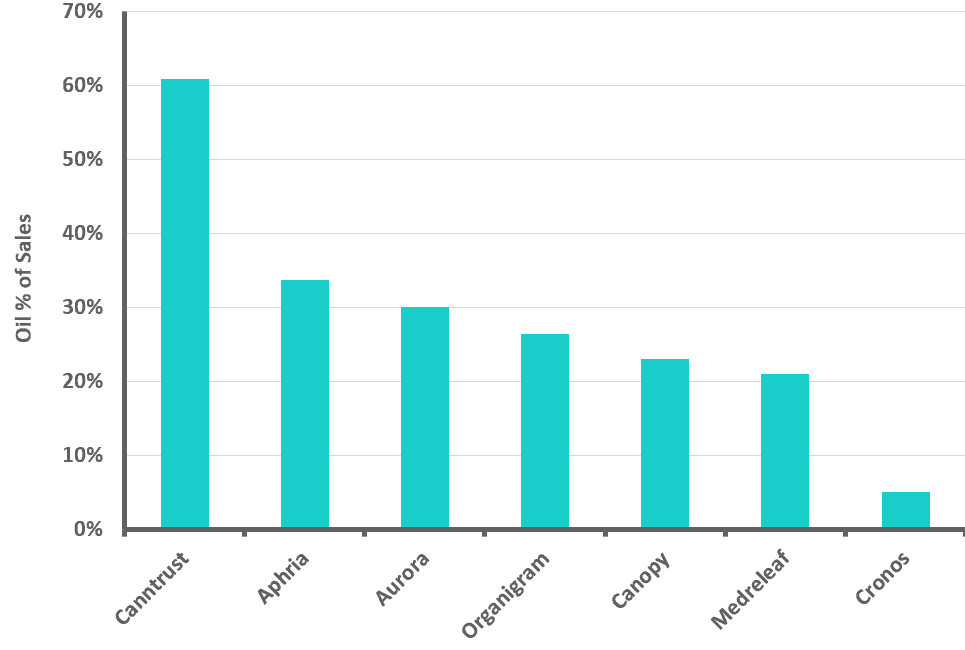

CannTrust – 60% of revenue comes from oil sales today, the highest in the industry.

Aurora Cannabis – Aurora will have 120,000 kg of oil extraction capacity operational by late 2019, the largest announced by the industry so far.

Canopy Growth – As the leader in the space you can assume Canopy is working on building extraction capacity to compete with the rest of the industry. They have the money and the expertise.

Current Revenue Split from Oil

The opinions provided in this article are those of the author and do not constitute investment advice. Readers should assume that the author and/or employees of Grizzle hold positions in the company or companies mentioned in the article. For more information, please see our Content Disclaimer.