Russia Shows Willingness for Continued Cooperation with OPEC

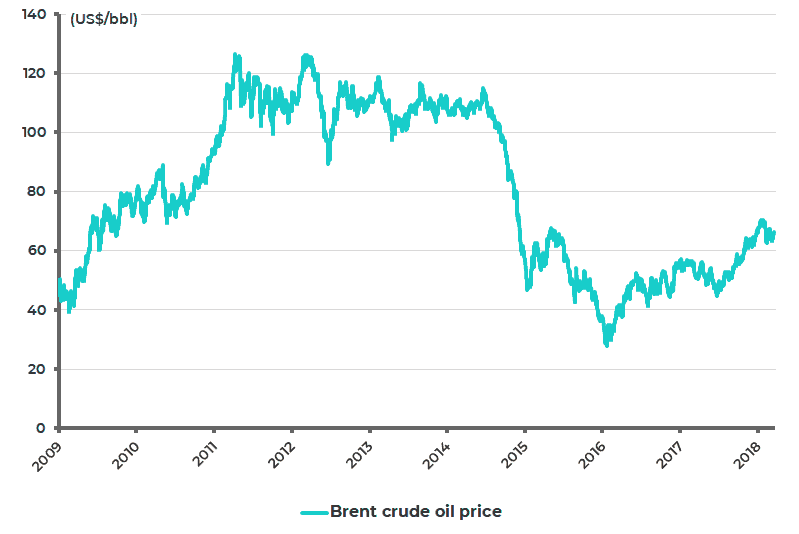

The oil price has remained in an uptrend of late. What are its prospects? This columnist had until recently been operating on the view that there is a natural ‘cap’ to any oil price increase because the assumption had been that North American shale production will rise to meet any increase in price as the incentive to produce more increases.

For such reasons the view has also been that Russia would not want to maintain the OPEC supply constraint deal if the oil price stayed above US$70/bbl for an extended period of time because of the risk that the higher price would encourage shale production and reduce Russia’s market share.

Brent Crude Oil Price

Source: Bloomberg

But Russia has of late signaled that it is still happy to continue to go along with the OPEC production agreement, the formation of which in November 2016 has seen oil rising from US$27 at the bottom in January 2016 to US$70 in late January 2018 and US$66 at present (see previous chart). Thus, Russia extended the OPEC production deal to the end of 2018 at the last OPEC meeting in late November. It should be noted that OPEC still accounts for about 40% of global crude oil production and Russia for 11%.

The Global Economy Runs on Oil Not Batteries

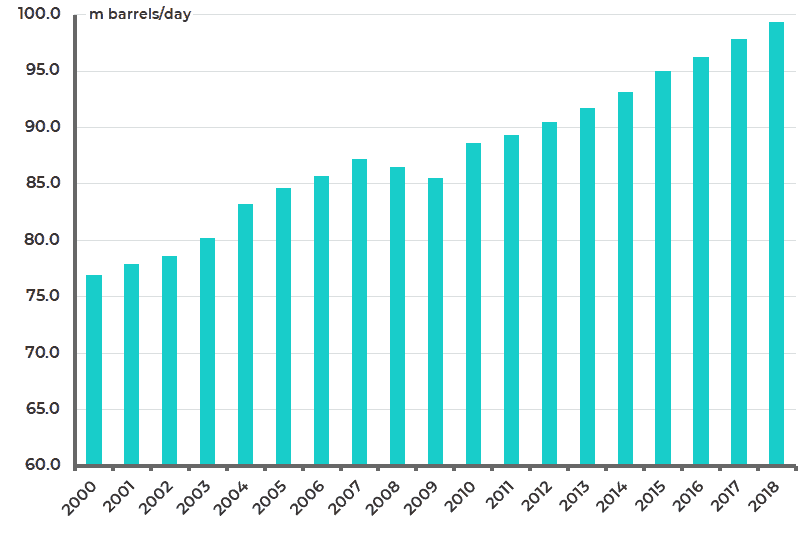

Meanwhile, a closer look at the data has caused a questioning of those previous assumptions on oil. First, there has been a spectacular collapse in oil discoveries in recent years relative to consumption, most particularly as oil consumption has continued to grow strongly. Global oil demand has risen from 85.5m barrels/day in 2009 to an estimated 97.8m barrels/day in 2017 and a forecast 99.3m barrels/day in 2018, according to the International Energy Agency (see following chart).

As a result, conventional oil discoveries reportedly replaced just 7% of world consumption in 2016 as the world’s oil companies capitulated to the alternative energy and electric vehicle hype of recent years and slashed exploration budgets.

Global Crude Oil Demand

Source: International Energy Agency

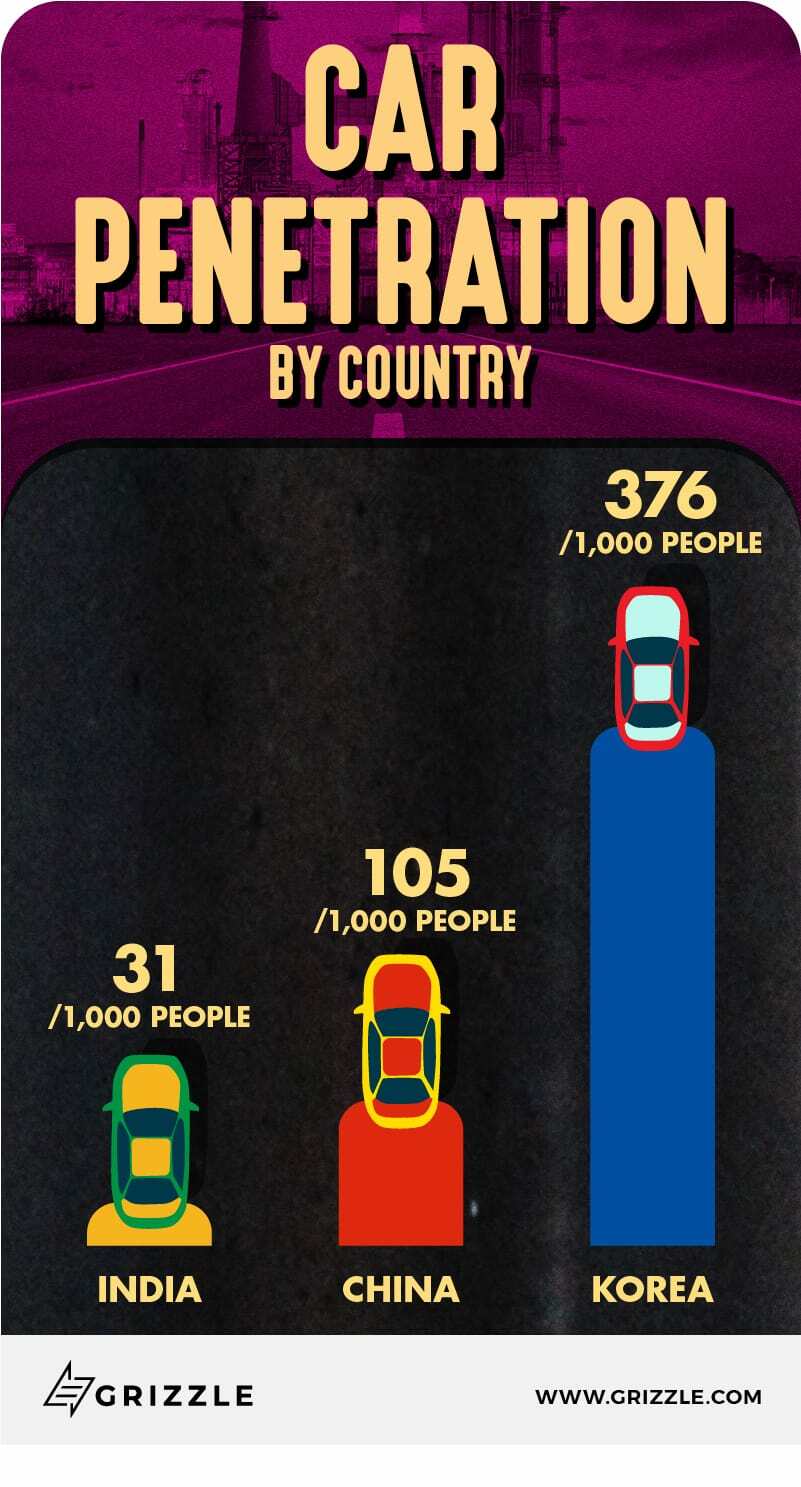

While battery-powered passenger cars are a real story, it is going to be a long time before electric vehicles take over in India or Indonesia, for example, as opposed to the streets of California. And in India the potential for car sales to explode in the next several years is enormous given car ownership rates relative to China.

Car penetration is around 30 per 1,000 people in India, compared with about 100 per 1,000 people in China. It also helps that, under Prime Minister Modi, India is building a lot of roads. Another point is that an estimated 6% of oil demand is driven by civil aviation. And no one is talking about battery-powered airplanes yet.

Source: US DOE, OECD

US Shale: Showing Signs of Financial and Geological Exhaustion

The other issue as regards to oil is whether shale production will respond as dramatically to a higher oil price as had been previously supposed. The first point is that lenders to shale producers are much more circumspect than before, following the financial problems of many shale producers as a result of oil’s collapse to a low of US$27/bbl in January 2016.

Second, and perhaps most interestingly, some of the best shale drilling areas are showing the first signs of ‘field exhaustion’. So while shale activity undoubtedly has picked up significantly as oil has rallied, the ability to increase production in response to higher prices is not unlimited.

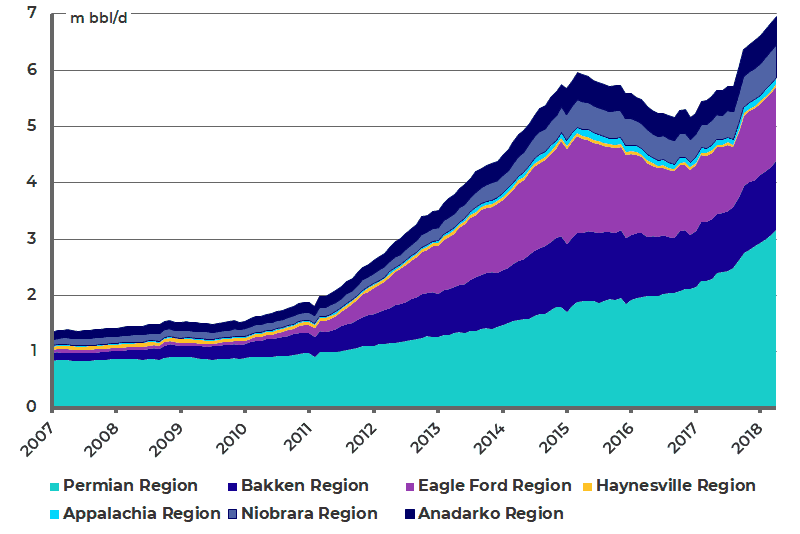

US shale production in the seven shale regions is projected by the Energy Information Administration (EIA) to rise by 131,000 barrels per day in April to 6.95m barrels, according to the EIA’s monthly drilling report (see following chart).

US Oil Production from 7 Major US Shale Regions

Source: US Energy Information Administration (EIA) – Drilling Productivity Report

Russia — the Best Positioned Emerging Market Play for Higher Oil Prices

This columnist does not claim to be an expert on oil and is certainly no geologist. Still, the tentative conclusion is that investors should be prepared for a much higher oil price than had previously supposed even assuming no Middle East conflict in terms of a breakout in formal hostilities between Iran and Saudi Arabia.

Indeed, the CEO of Russia’s Oil major Lukoil, Vagit Alekperov, warned at the Davos meeting of the world’s great and good in January that it was important to prevent the ‘explosive’ growth of oil up to US$150 per barrel.

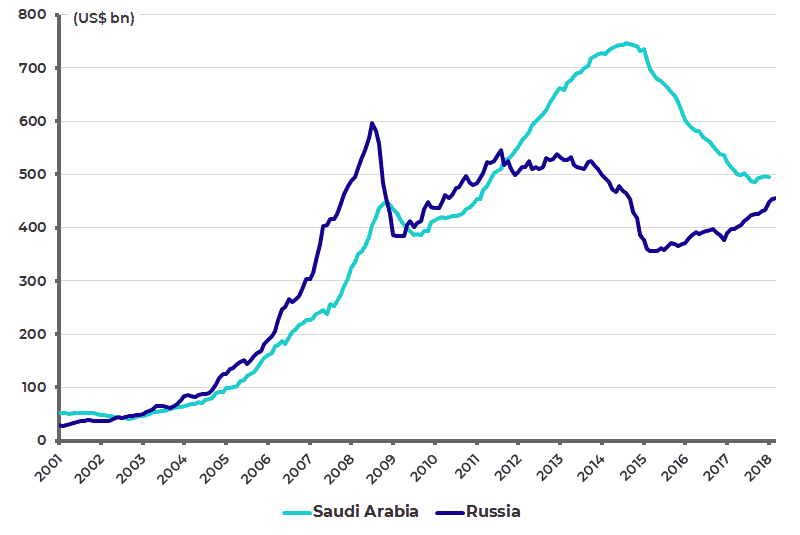

From an investment standpoint this is also an argument for investors in emerging market equities to look not just at Asia, with Russia one obvious example. In this respect, it should be remembered that Russia’s macroeconomic situation is far more stable than Saudi Arabia’s in terms of the trend in foreign exchange reserves and the like.

Russia’s foreign reserves have risen by 28% since April 2015 to US$455 billion in early March, while Saudi Arabia’s foreign reserves have declined by 34% since peaking at US$746 billion in August 2014 to US$495 billion at the end of January (see following chart). Meanwhile, the Russian budget still assumes an oil price of only US$40/barrel meaning there is plenty of fiscal headroom.

Russia and Saudi Arabia Foreign Reserves

Source: Saudi Arabian Monetary Agency, Central Bank of Russia

Interestingly, in early January Russia opened an extension to the Eastern Siberia-Pacific Ocean (ESPO) oil pipeline to China, doubling its export capacity to China to 30 million tonnes a year. The imports are, interestingly, priced in renminbi, in one of many signs that Russia and China are seeking to end the hegemony of the US dollar standard. On a related subject, China is due to launch renminbi-denominated oil futures contracts in Shanghai on March 26.

The views expressed in Chris Wood’s column on Grizzle reflect Chris Wood’s personal opinion only, and they have not been reviewed or endorsed by Jefferies. The information in the column has not been reviewed or verified by Jefferies. None of Jefferies, its affiliates or employees, directors or officers shall have any liability whatsoever in connection with the content published on this website.

The opinions provided in this article are those of the author and do not constitute investment advice. Readers should assume that the author and/or employees of Grizzle hold positions in the company or companies mentioned in the article. For more information, please see our Content Disclaimer.