BITCOIN – COIN REVIEW

Bitcoin (BTC) is the ‘original’ cryptocurrency and has become the torchbearer and de-facto comparator for all other digital crypto assets. Bitcoin has rapidly penetrated the popular lexicon unlike any other new technology. Beyond its popularity and price appreciation, there are fundamental aspects of Bitcoin, the underlying technology and the infrastructure that support the Bitcoin ecosystem, which have the potential to drastically disrupt many areas of modern life, predominantly the storage of economic value.

BITCOIN REVIEW

Pros

- Best in class liquidity (easiest to trade)

- Well established technology and public interest

- Provides access to other crypto (common trading pair)

Cons

- Scaling challenges (transactions/second)

- During times of high activity transaction fees can be relatively high

- Consumes a significant amount of energy during mining

BACKGROUND

In October of 2008, the collective (or the man) known as “Satoshi Nakamoto” initiated the ‘blockchain revolution’ by authoring the seminal white paper ‘Bitcoin: A Peer-to-Peer Electronic Cash System’.

A few months later, Satoshi mined the first block of bitcoin (50 bitcoin in total), in January of 2009, Bitcoin was born. Beyond laying out some of the technological innovations in the whitepaper, what Bitcoin truly did was set the standard by which all other cryptocurrencies and digital crypto assets are now measured.

Crypto Standards

Bitcoin seeks to provide a DECENTRALIZED and TRUSTLESS means to SECURELY transfer value ANONYMOUSLY between users in an OPEN ledger where validated transactions are IRREVERSIBLE.

Challenges to Adoption

While Bitcoin may be the gold standard in the crypto community, it still faces several challenges that limit its adoption, utility and scalability.

Decentralization at risk – The mechanism for validating transactions in Bitcoin, referred to as mining, is predominantly controlled by large concentrated consortiums, which risk the decentralization of the ecosystem.

High environmental impact – The mining process utilizes increasingly massive amounts of energy, which challenge the adoption of Bitcoin to the growing socially conscious segment of the public concerned with environmental impact.

Hard to Scale – Based on the current details of the Bitcoin protocol it’s utility and scalability as a currency is limited since the amount of transactions that can be processed in a given amount of time is constrained. In times of high network volume there can be long delays to validate transactions unless higher transaction fees are included.

High transaction fees – As noted above, additional transaction fees may be needed to ensure quick processing of a payment, thereby limiting the use of Bitcoin for small value transactions.

While the list of places you can actually use Bitcoin as a currency is growing, it’s far from functional for day-to-day life. Its primary use currently is as a speculative vehicle to store wealth.

Open-source Conflict

While working on solutions to these problems, the open source community behind Bitcoin has also faced criticism. Rifts in the community over how to implement particular solutions have led to splinter digital crypto assets of Bitcoin called forks, further adding confusion to the general public as to what Bitcoin really is and how it’s different from Bitcoin Cash, Bitcoin Gold, etc.

Fundamentally, the teams behind Bitcoin have a vested interest in improving the platform’s limitations versus competing cryptocurrencies, all the while staying true to the original principles of Satoshi’s whitepaper.

DEVELOPMENT TEAM

Bitcoin v0.1 was released on January 9, 2009 by ‘Satoshi Nakamoto’ to the same cryptographic mailing list where Satoshi shared the Bitcoin whitepaper. The code was shared open source.

Although Satoshi worked with several key developers on improvements, he retained control over the development until the middle of 2010. At that point Satoshi passed primary control of development over to one of those key early developers, Gavin Andresen, by making him the head developer at the Bitcoin Foundation.

Since then, a vibrant open source and increasing number of developers have contributed to Bitcoin Core, the client software that runs most of the network. Anyone can contribute to the project and all code is shared publicly on Github where an active community maintains and improves the codebase.

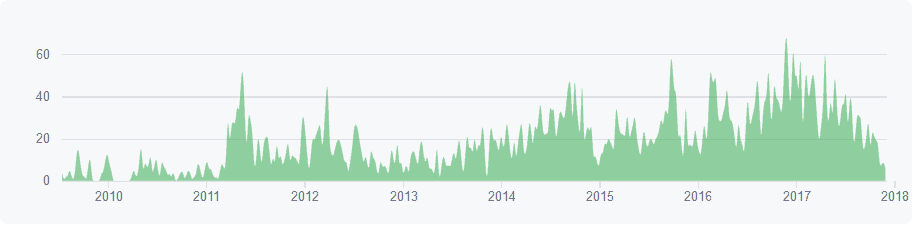

Number of changes (commits) to the master Bitcoin code. Source: [https://github.com/bitcoin/bitcoin/graphs/contributors]

The most notable of these hard forks is Bitcoin Cash (BCH), which occurred on August 1, 2017. The principal disagreement causing this digital divorce was over how to improve the scalability of Bitcoin.

One development group wanted to implement a certain change to increase transaction speed called Segwit and another group felt that change wasn’t enough and wanted to make a different and more drastic change by increasing the block size from 1MB to 8MB.

Since all changes to Bitcoin Core need to go through an arduous test of getting consensus among the community, the group proposing the more drastic change decided to break off and create their own coin called Bitcoin Cash (BCH).

The important thing to note from this example is that the process by which Bitcoin is developed, although thorough and fair due to it’s open source nature and how contributions are considered, can cause important changes to be held back because of the long debate required to agree on a solution.

COIN SUPPLY

There can only ever be a total of 21 million Bitcoin ever created by design. Currently, about 80% of those have been created (mined in cryptospeak). There’s a definitive supply schedule for bitcoin that controls exactly how many bitcoins are created over time.

BTC are created by ‘miners’ who perform complicated computations to validate the transactions in each block and are provided with a block reward, which is currently 12.5 BTC.

The protocol is designed so that a block is created or validated every 10 minutes. The block reward halves every 4 years, but as the amount of computational mining power on the network adjusts, the difficulty of the mining adjusts (every 2016 blocks or about every 2 weeks).

Although there’s some variance around the 10 minute/block target, the number of Bitcoin in existence can be predicted fairly reasonably at any given time. Based on current estimates over 99% of all Bitcoins will be mined by 2041 with the final portion of BTC to be mined by 2140.

Having a reasonably predictable supply schedule for the number of bitcoins in circulation has a deflationary impact on any BTC driven economy. But there are two other factors that affect the spendable supply of BTC:

- BTC can be lost if the holder stores the coins in a wallet then subsequently loses that wallet and the recovery passphrase.Analysts from Chainalysis, via Fortune, estimate the amount of BTC lost in this way to be between 1.7 and 2.7 million BTC.

- During the early days of Bitcoin, Satoshi Nakamoto is estimated to have mined over 1 million BTC. Since his disappearance there has been widespread speculation as to whether those coins will ever reappear along with Satoshi to claim the massive fortune that those coins would now be worth.

The challenge for Bitcoin will be to keep the average owner of BTC from holding (‘hodling’ in crypto slang) onto their coins waiting for the price to appreciate, thus removing liquidity from the market.

Deflation is good for the value of BTC, but without the ability to offer reasonably frictionless (quick and easy) transactions, large-scale adoption of Bitcoin will be limited. Given the amount of interest in supporting the Bitcoin ecosystem and the solutions already under development, in the medium to long term the value of BTC should continue to appreciate.

COIN VALUE LINKED TO SUCCESS OF BLOCKCHAIN PLATFORM

Bitcoin was originally conceived as a transactional currency. Satoshi’s’ vision, as outlined in his whitepaper, was for Bitcoin to be a “peer-to-peer version of electronic cash [which] would allow online payments to be sent directly from one party to another”.

While use of Bitcoin as a transactional currency has been increasing over time with some truly novel and quirky ways to utilize BTC for purchases, the main utility right now for BTC is as a long-term store of value. In this regard, Bitcoin has performed exceedingly well — the platform has enabled amazing appreciation in price of BTC primarily based on its use as a speculative investment.

It appears as though BTC has become the beachhead through which investors and the general public are accessing this new realm of digital crypto assets or cryptocurrencies. Further, in order to invest in many of the other digital crypto assets sometimes referred to as altcoins many exchanges require users to first convert their fiat currency (i.e. USD, EUR, CNY, etc) into Bitcoin, Ether or Litecoin.

This means that for any person wishing to trade in crypto they will likely need to hold a fair amount of one of those three coins to facilitate other transactions. Since BTC is by far the most well known, it’s typically the first choice.

Although some prominent Bitcoin proponents still advocate improving its utility as a transactional currency, the trend has seemingly gone in the opposite direction. Along with speculative investors wishing to put their money into the ‘blue-chip’ of cryptocurrencies, the use as an intermediary currency in the digital crypto asset space bodes well for Bitcoin’s utility as a long-term store of value similar to how gold is seen in traditional markets.

STRENGTH OF THE COIN ECOSYSTEM/BLOCKCHAIN

Even if Bitcoin wasn’t the very first digital asset, it was certainly the first one to be secured with modern cryptographic techniques. It also defined how blockchain works and the blockchain concepts behind Bitcoin have become the bedrock of almost all other cryptocurrencies. Having been around the longest and having defined the principles behind how blockchain can be used as a digital crypto asset has allowed a very healthy ecosystem to grow around Bitcoin itself.

Despite the decentralization of Bitcoin, adoption of its open standards and protocol has spread very quickly among important stakeholders. A nascent industry is developing around the Bitcoin protocol, such as:

- Exchanges offering liquidity and currency conversion to consumers

- Currency wallets offering means for users to securely store their coins

- Mining consortiums validating the transactions while minting BTC by the day

Source: Bitcoin Magazine https://bitcoinmagazine.com/articles/finance-and-beyond-an-infographic-map-of-bitcoin-and-the-emerging-blockchain-ecosystem-1461789453/

Given that Bitcoin’s market cap has well surpassed the $100 billion mark it makes for one attractive honeypot for unscrupulous characters trying to hack into that massive store of wealth.

But, only once in 2010, has the actual underlying technology been exploited, and that was identified and rectified within a matter of hours. Interestingly, ‘Satoshi’ helped fix that exploit and it was only later that year that he handed over the reigns of development.

Other hacks or exploits Bitcoin is famous for have all been on the periphery: exchanges, wallets or other middlemen who link Bitcoin to the traditional fiat currency. A strong argument can be made that the industry and public is learning how to protect themselves better with each case. One famous example is the Mt. Gox hack in 2014 where 850,000 BTC were stolen from the largest exchange at the time. That particular case is still tied up in legal proceedings in Japan. Victims of that particular hack may still recover at least a portion of their BTC at current market value, which would be a huge windfall for many who thought their BTC were gone for good.

The Bitcoin ecosystem is growing and improving everyday. As are the information sources and solutions for the public to ensure they safely transact in the world’s most valuable digital crypto asset.

UNDERLYING TECHNOLOGY/FUTURE PROOF

The pace of Bitcoin’s development has been both impressive AND hypnotizing. Anyone can follow along the development by signing up or perusing the archives of the mailing lists, following the discussion in forums or going to the growing number of in-person events. The technology behind Bitcoin may be complex, but all those lines of code protecting billions of dollars worth of value still have challenges ahead to ensure that Bitcoin can maintain its market leadership.

The massive growth in the popularity of Bitcoin has posed challenges for the technology to scale with the demand. The most common complaint regarding Bitcoin’s technology is its relatively slow transaction speed.

By design, each block in the Bitcoin blockchain is a fixed size, which means only a certain number of transactions can be included in each block. Also by design, blocks are only added to the chain about every 10 minutes and this can sometimes lead to long waits for transactions to be validated to the official ledger. This challenge affects the scalability of the Bitcoin network as it cannot handle the transaction volume and provide sufficient liquidity to meet demand.

There are several potentially promising solutions already developed that are awaiting adoption, such as:

Segwit – reduces the amount of data required to be stored in each block

Lightning network – creates off-chain payment channels

Atomic swaps – allows cross-currency transactions to happen instantly without exchanges or fees

Adoption has been slow, but that’s part of the process when working in an open distributed ecosystem with no central authority. However, it’s abundantly clear that based on the interest in Bitcoin the technology exists to resolve the transaction-speed challenge. Although it may take some time, the best technological solution will win in the end.

The other, as yet unresolved, issue is the impact of Bitcoin’s Proof of Work validation method employed through Bitcoin mining. For a Bitcoin transaction to be validated and added to the ledger, miners need to do ‘work’ (spend electricity to run calculations on computer systems) to find a solution to the SHA-256 cryptographic hash.

The system works like a digital lottery where the first miner to find the correct solution to the current hash gets the block reward and any transaction fees included to expedite transaction validation. To maintain its supply schedule and that 10-minute per block target, mining difficulty increases or decreases based on the amount of computational power (hashrate) on the network.

As demand for transactions have gone up due to the popularity of BTC and as mining has become more lucrative, the hashrate has been rising, which means the amount of energy used by miners is also going up.

There has been much debate, and not much real study yet on the energy usage of Bitcoin’s mining. There are some who claim that mining Bitcoin has more detrimental impacts on the environment than Bitcoin’s cousin, gold. Regardless of whether that analysis is correct or not, one thing is clear: mining Bitcoin is not as energy efficient as it could be.

The computational cycles wasted by those hoping to win the Bitcoin proof of work lottery seem needless when other solutions that ensure the integrity of transaction validation exist. Unlike gold mining, since Bitcoin is a purely digital crypto asset, it’s possible to make changes to the protocol that will significantly reduce its environmental impacts. Doing this, however, requires the attention and care of the development community and the ecosystem at large.

Getting the world to implement global prices on carbon would be a step towards ensuring miners have the incentive to improve the protocol in a step that will be more sustainable in the long term.

ADDRESSABLE MARKET

When considering the addressable market for Bitcoin, it’s our opinion that simply comparing it to transactional platforms like Visa or fiat currencies just doesn’t make sense. Even though that may have been ‘Satoshi’s’ vision, that is neither what Bitcoin has become nor what the market has used it for.

The best comparison to Bitcoin from an addressable market is gold. Gold has historically found a place for investors who want a conservative asset class within their portfolio. As irrational as it may seem to attribute a value to gold, which is much greater than its utility in electronics or the like, the price of gold has been inflated based on its history as a reserve stock for backing fiat currency.

Bitcoin is THE conservative asset in the emerging digital crypto asset class and just like what gold used to be, Bitcoin provides the benchmark to price for most other assets in its class. The gold market is approximately $7.3 trillion USD. With Bitcoin’s current market cap still measured in the 100’s of billions there is still clearly a lot of room to grow.

Bitcoin enthusiasts will also point out that the cryptocurrency still does have potential to eat into the peer-to-peer payment market if improvements to speed transaction and increasing liquidity happen. But until Bitcoin shows that it can carry its weight with the Visa’s and Paypal’s of the world, it’s too soon to determine how much of the payments market it could capture.

PUBLIC INTEREST

Public interest in Bitcoin has grown amazingly since its inception in 2009 when it was limited to the very technologically savvy. But with its rise in popularity over the past couple of years, the public has also become aware of Bitcoin’s challenges, limitations and most importantly, the new competitors in the digital crypto asset landscape.

Signs of Bitcoin’s demise recently seem to mirror its reduced interest as shown in the web search results. However, this is not the first such swoon that Bitcoin public interest (and price) have taken in its brief history. Given its establishment as the de facto digital crypto asset in the mindspace of the general public, the interest in Bitcoin is sure to continue as the market in cryptocurrencies matures.

SCALABILITY

Though the coin faces some serious challenges with regards to scalability, some promising potential solutions are on the horizon. Other coins may offer better solutions for high volume, low value transactions. But, if as it appears, Bitcoin will become a store of value rather than a transactional currency, then simply removing much of the friction and delays caused by the current Bitcoin protocol using solutions to take aspects of transactions off of the Bitcoin blockchain should be more than sufficient.

Currently, those solutions are still facing challenges of adoption, both in terms of time it takes for exchanges and wallets to integrate them as well as competing interests. The demand for a faster more scalable Bitcoin network is there and solutions are on the horizon. However, until the average user can access and transact bitcoins in a reasonable amount of time with fees comparable to other stores of value then Bitcoin still has room to improve.

PROMINENT INVESTORS/BACKERS

Even though Bitcoin was designed around a principle of privacy, allowing users to mask their identity (pseudonimity) by way of the public key used for their wallet, there are ways to track a wallet public key back to an individual person unless additional precautions are taken. For example, because of the large amount of BTC which ‘Satoshi’ was known to have mined in the early days of the protocol, several enthusiasts have done analysis on some of the early Bitcoin blockchain to attempt to confirm that he controls 1m BTC.

In addition to these block analyses, several prominent investors have made public their interest and stake in BTC:

- The Winklevoss twins, most famous for their association with the early days of Facebook, made public their investment of $11 million worth of BTC in 2013, likely in an attempt to lay the groundwork for a later failed attempt at creating a Bitcoin Exchange Traded Fund (ETF).

- As part of its crackdown on some of the seedier parts of the internet, the FBI in 2013 seized over 144,000 BTC from the owner of Silk Road a website which served as a black market for drugs and hackers. The US government has since auctioned off those Bitcoins for a total of $48.2 million which at today’s prices would be measured in the billions.

- Other famous advocates and early adopters of Bitcoin such as Gavin Adresen, Roger Ver and Barry Silbert likely still hold large amounts of BTC based on their known involvement with Bitcoin, but the exact amounts they control currently is unknown.

Recently, analysis has been done to show that over 40% of BTC is controlled by less than 1000 people. This concentration of the value of Bitcoin may seem large, but when compared to the concentration of wealth in the top 1% of traditional currency it pales in comparison. Bitcoin may not be the solution for the 99% of the worlds population yet but it is a significant step in the right direction.

LIQUIDITY AND VOLATILITY

As Bitcoin is the largest and first cryptocurrency it enjoys the the advantage of having the deepest liquidity pool relative to all other coins. The average 24-hour dollar value traded volume for the last 30 days for BTC was $14.5B, relative to the average market capitalization over the same period of $236.4B, implying 6.1% of the float is traded daily. Among ‘blue chip’ cryptocurrencies, Bitcoin is the most liquid.

Cryptocurrencies are inherently highly volatile investments (new market, coupled with small market capitalizations), the lower the relative price volatility the better (less shaky hands are holding the asset). Bitcoin has the lowest 90-day average daily price volatility among the top 10 cryptocurrencies, at 115% (annualized figure).

TOTAL SCORE

We’re still in the early adoption phase of digital currencies. Given the relative size and liquidity of BTC versus other cryptocurrencies, it will be the first digital coin owned by most newcomers.

Bitcoin is the bellwether for the entire digital and cryptocurrency asset class. As a store of wealth, Bitcoin will conceivably take market share from gold, which can certainly underpin significant upside over the long-term. Bitcoin should be viewed as a core holding in any diversified digital crypto asset portfolio.

Users should be aware that if they click on a cryptocurrency link and sign up for a product or service, we will be paid a referral fee. This in no way affects our recommendations, which products we choose to review or our advice which is the sole opinion of the authors.

The opinions provided in this article are those of the author and do not constitute investment advice. Readers should assume that the author and/or employees of Grizzle hold positions in the company or companies mentioned in the article. For more information, please see our Content Disclaimer.