Investing on the frontier of massive trends is where real money is made, and it doesn’t get any bigger than the legalization of marijuana. The global legal marijuana market is estimated to be worth $8 billion and roughly $3.2 billion of that demand is in the US. We take a deep dive into the growth dynamics of the US market and see where the best investment opportunities are to capitalize.

The Potential Size of the US Marijuana Economy

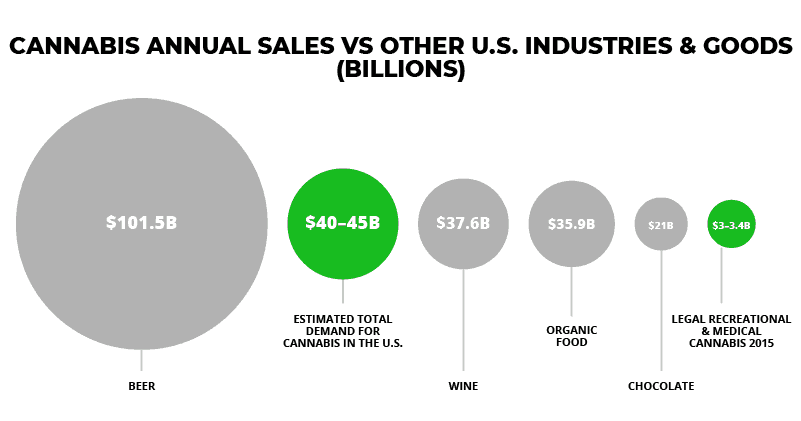

The US marijuana economy is growing at a very healthy clip: 30% per year. The prize is significant — the graph below shows the key areas of upside:

Phase 1 – The growth of the current legal and recreational markets in the US to full national recreational legalization. This would effectively displace the current black market supply, taking the market from $4 billion currently to over $40 billion (10x growth).

Phase 2 – The legalization of marijuana should theoretically grow the overall market. The most bullish estimates suggest the total market could reach the size of the US beer industry, increasing sales from $40 billion to $100 billion (1.5x growth).

Source: Brewers Association, Wine Institute, Fortune, candyindustry.com, Statista and Euromonitor Note: Unless otherwise noted, comparable industry figures are for 2014

Politics — Biggest Near-term Hurdle

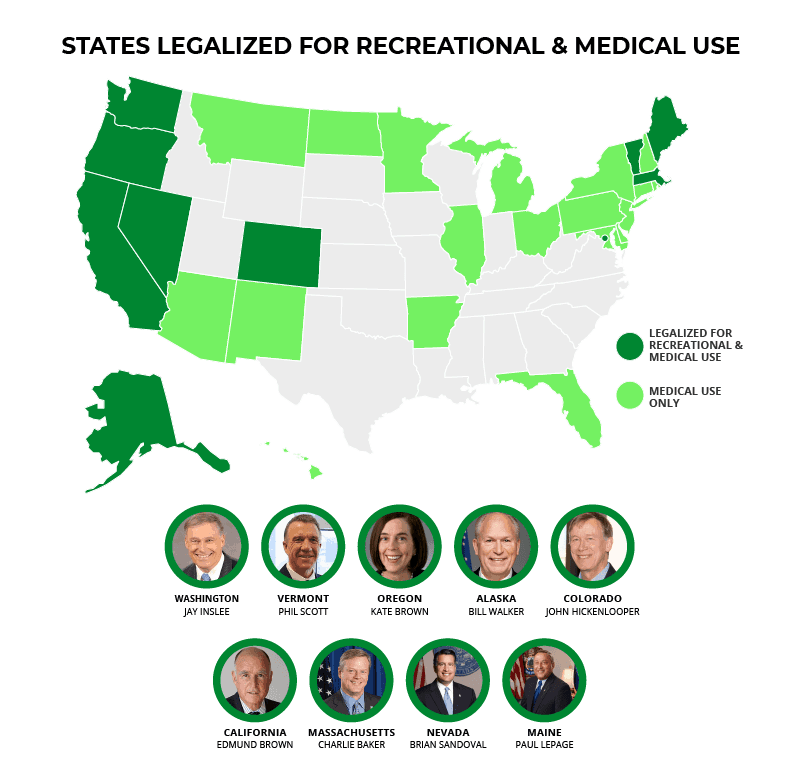

There are currently nine states in the US that are, or are on a pathway to, fully legalizing recreational marijuana use. As one would expect, a majority of these states are Democratic. However, we’re seeing the tide shifting in the political landscape, with Gov. Phil Scott of Vermont the latest Republican to usher in a legalization on January 22nd.

The ‘family values’/Bible belt states remain strongly anti-legalization, making it likely that a large portion of the country will continue to source from the black market (i.e. Mexican drug cartels) for the foreseeable future.

US Attorney General Jeff Sessions (poster-elf for all far-right causes) took a hammer to the marijuana industry on January 4th, when he rescinded Obama-era regulations that relaxed enforcement of federal law (marijuana is still illegal under the federal Controlled Substances Act).

Source: NY Times, Independant, Statista Note: As of November 10, 2016 laws in some states have not yet taken effect. Some states not highlighted allow limited medical marijuana access.

Grizzle views the US legal marijuana market growing at a much slower clip than much of the bullish estimates by analysts and industry observers, given the structural political challenges that remain towards full legalization in the country. We believe realistic near-term upside for sales in the industry to be in the $20 billion range.

There are effectively three main ways to capitalize in the new marijuana economy:

- Invest in marijuana stocks

- Grow marijuana

- Retail marijuana product

Investing in Marijuana Stocks

For a US-based investor there are very limited avenues to get direct exposure to the recreational marijuana economy through the US stock market. Let’s look at the constituents of the US Marijuana Index. There are only 15 companies in index with a total market capitalization of $4.3 billion, GW Pharmaceuticals (cannabinoid-based medicine) representing $3.2 billion.

Top 5 US Marijuana Equities

| Name | Ticker | Price ($) | Market Cap |

| GW Pharmaceuticals | GWPH | 111.08 | $3.24B |

| Axim Biotechnologies | AXIM | 5.05 | $275M |

| Kush Bottles | KSHB | 5.16 | $318M |

| Terra Tech | TRTC | 0.26 | $236M |

| MPX Bioceutical | MPX | 0.71 | $244M |

An interesting fact is that none of the constituents of the US index are actually growing marijuana! As marijuana remains illegal at the federal level, legal state growers (e.g. California) are unable to list on the public stock market. We view most of these US-listed marijuana companies as fringe plays at best — a group of highly speculative and unprofitable biotechnology stocks trying to capitalize on a trend.

The Canadian Marijuana Equity Bubble

Savvier US investors have found refuge in the full-blown marijuana equity bubble in Canada. The equities have been on an absolute tear, with the Canadian Marijuana Index returning 161% in 2017. The market is certainly much deeper in Canada, with 24 constituents in the index and a market capitalization of $30.8 billion. The largest company — Canopy Growth — has a market capitalization of nearly $6.8 billion.

The vast majority of the companies in the Canadian Marijuana Index are growers, with their business primarily focused in the Canadian market. The size of the overall Canadian market (medical and recreational) is a fraction of the US market: $6 billion vs. $40 billion respectively.

The strong demand for marijuana exposure by retail investors has driven valuations deep into bubble territory. The companies themselves are entering suspect M&A deals to add additional supply with the most recent example being Aurora Cannabis acquiring CanniMed Therapeutics for a staggering $1.2 billion.

Top 5 Canadian Marijuana Equities

| Name | Ticker | Price ($) | Market Cap |

| Canopy Growth | WEED | 35.29 | $6.7B |

| Aurora Cannabis | ACB | 14.57 | $6.6B |

| Aphria | APH | 20.94 | $3.4B |

| MedReleaf | LEAF | 24.05 | $2.3B |

| Cronos | MJN | 11.10 | $1.7B |

Investing in marijuana equities, either in the Canadian or US market, is functionally the easiest way to get access to the thematic upside, however given the fact most US-listed names have little real direct exposure to marijuana sales and Canadian equities are so expensive we think it’s more than prudent and reasonable for investors to wait for a better entry point.

Growing Marijuana

We believe the best economics currently in the entire marijuana value chain is found in growing marijuana directly, recreationally or commercially. The economics are so compelling relative to most other investments (i.e. the stock market) that it’s a virtual no-brainer to grow marijuana in a state that legally allows you to do so. Of the states that have legalized recreational marijuana use, Washington is the only one that doesn’t allow home grow (which could be changing very soon).

Personal Grow

The table below presents the personal grow possession specifics for legal recreational states. Most states explicitly state that selling homegrown marijuana is illegal, however, enforcing that law is far more challenging. The Colorado experience proves that when prices rise there’s a strong response from the black market (home grow).

| State | Possession Limits per Person | Recreational Grow Limits per household |

| California | 28.5 grams | 6 plants |

| Colorado | 1 ounce | 12 plant |

| Alaska | 1 ounce | 12 plants |

| Maine | 2.5 ounces | 18 plants |

| Massachusetts | 1 ounce in public / 10 ounces at home | 12 plants |

| Nevada | 1 ounce | 6 plants (if within 25 miles of dispensary) / 12 plants (more than 25 miles away from dispensary) |

| Oregon | 8 ounces | 4 plants |

| Washington | 3 ounces | n/a |

| Vermont | 1 ounce | 2 plants |

Commercial Grow

The biggest barrier to entry to growing marijuana at commercial scale in all the US states is the sheer weight of regulatory burden. It’s expensive to secure licences from a legal perspective, and once licences are secured the costs of security, packaging, licensing and regulatory fees can quickly eat into profits.

States such as Massachusetts and Colorado are looking to make meaningful amendments to their local laws to allow the ‘craft’ marijuana industry to develop. Once the regulatory burden is eased across the board we believe that growing marijuana commercially could offer some of the best returns in the industry — akin to microbrew beer companies.

Selling Marijuana Retail

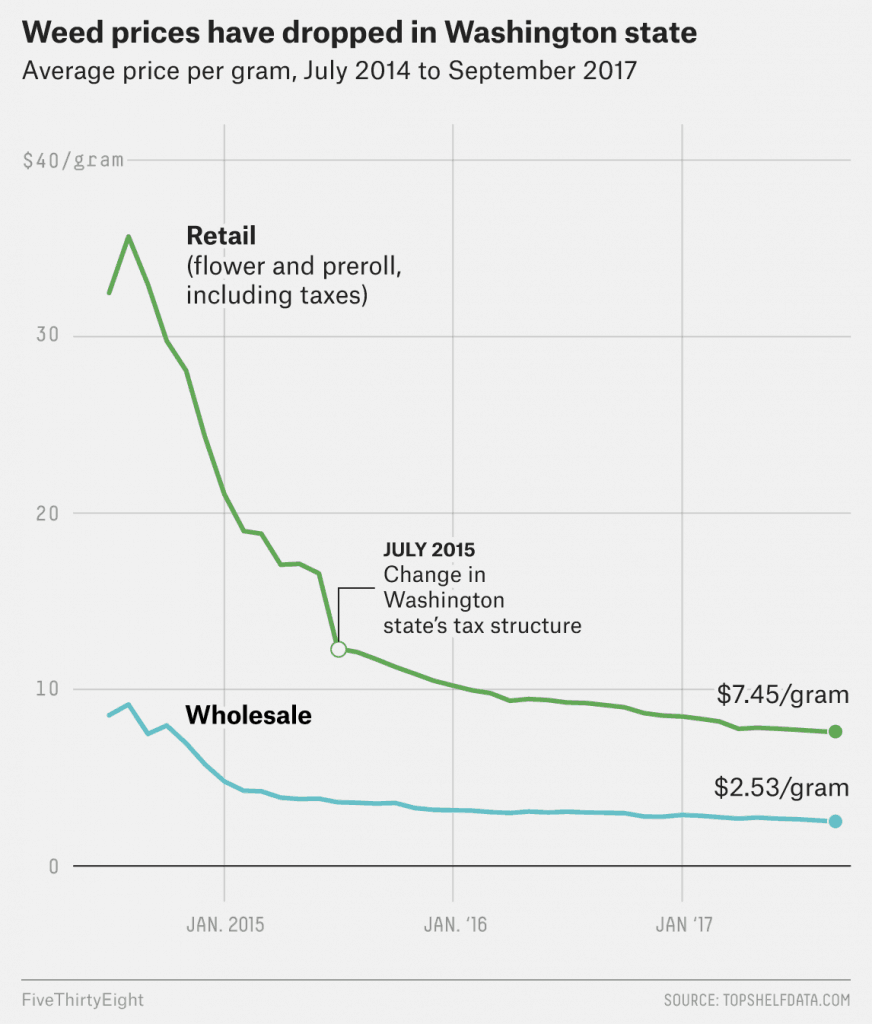

The graph below from FiveThirtyEight provides the best visualization of how challenging the dispensary business can be, looking at price evolution post-legalization in Washington state. In July 2014 the difference between the retail and wholesale price was $22/gram (gross margin for dispensaries), both retail and wholesale prices dropped significantly since that time. By September 2017 the gross margin compressed to $5/gram.

While the retail dispensary business can be very profitable at the onset of legalization, the low barriers to entry result in significant competition, driving down profitability to levels comparable to other retail categories (i.e. cafes).

Conclusion

Growing marijuana is the best opportunity to capitalize on the future growth of the industry at the current time. We believe that once marijuana equities correct (and they absolutely will), there will be interesting opportunities that present themselves. Patience in the investment game is THE virtue.

The opinions provided in this article are those of the author and do not constitute investment advice. Readers should assume that the author and/or employees of Grizzle hold positions in the company or companies mentioned in the article. For more information, please see our Content Disclaimer.