Cannabis Demand Could be Double Government Estimates

Bottom Line: If per person consumption in Canada looks anything like Colorado, demand could be double government estimates.

Higher demand will lead to a longer legal market shortage, higher retail prices and better financial results for pot stocks.

New Greenhouse in Europe Makes Aphria a Global Leader

Bottom Line: The deal was done at a $0.36 per gram multiple, cheap compared to $50/gram deals done by others earlier this year. Aphria now has a global reach that rivals all of the largest producers in Canada. No matter how or where cannabis demand develops, Aphria is well positioned to enter those markets quickly and at scale.

Pure Global Cannabis First to List in Germany

Bottom Line: Cannabis players who listed in the US have seen a surge in their stock prices and trade at a premium to Canada listed peers. Being one of the few listed cannabis stocks in Germany could be a positive catalyst for Pure’s stock price. We wonder what other producers will race to list in Europe.

Cronos Spending Big on Biotech Research

Bottom Line: Cronos is betting 5% of its market cap, more than any other producer, that cannabis R&D will lead to profitable business opportunities. The stock is now one of the most interesting ways to bet on pharmaceutical success. If Ginkgo successfully produces THC and CBD in a lab it could spark a bidding war for Cronos among large pharmaceutical companies.

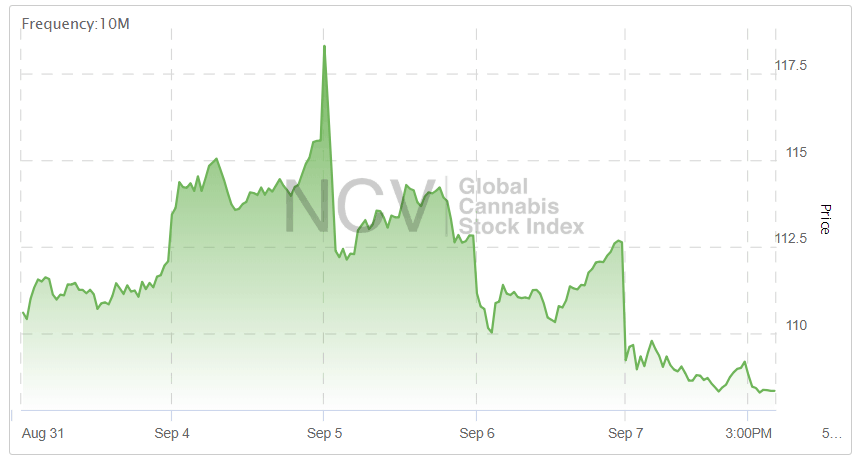

Marijuana Stock Performance for the Week

Global marijuana stocks gave back some of their gains this week with the index down 3%. Canadian licensed producers however continued to show strength, up 7%. Large cap stocks outperformed small cap stocks as has been the case throughout 2017. Marijuana stocks are now up 50% since the day before the Canopy Growth investment was announced by Constellation brands.

There is a significant M&A premium built into most of the large cap stocks as investors expect large corporations to enter the market through licensed producer buyouts. If these deals don’t occur soon stocks could retrace recent highs.

Market Outlook

Stocks are now back above the yearly low they reached on April 9. The Canopy Constellation deal gave the market some new momentum which could potentially carry stocks higher into the October 17 legalization date.

Once the market opens we expect retail and wholesale price compression from a legal oversupply. Falling cannabis prices will pressure producer stocks in the second half of 2019.

New Cannabis Ventures

READ LEGALIZATION IS INEVITABLE IN AMERICA FOR AN IN-DEPTH REPORT ON WHY FEDERAL LEGALIZATION COULD BE A REALITY IN LESS THAN 3 YEARS

The opinions provided in this article are those of the author and do not constitute investment advice. Readers should assume that the author and/or employees of Grizzle hold positions in the company or companies mentioned in the article. For more information, please see our Content Disclaimer.