COVID-19: Divergence between Cases and Deaths

The “second wave” concerns have continued to accelerate, most particularly in America. Still, this writer continues to draw comfort from the divergence between cases and deaths.

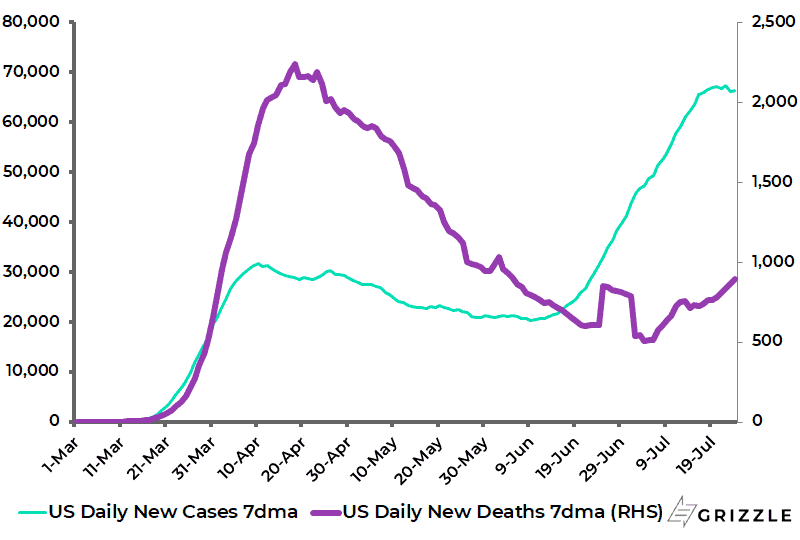

The 7-day average daily new cases in America has more than tripled from 20,363 in early June to 66,402 over the past week while average daily new deaths have declined by 60% from the peak reached in April (see following chart).

US daily Covid-19 new cases and deaths (7-day moving average)

Source: Johns Hopkins University

What would now be very concerning is if deaths start to rise meaningfully in the US after a lag. But so far this is not yet really the case.

Meanwhile, a near-term pickup in cases should be expected in Western Europe since this is the region where re-opening has gone furthest, borders have opened and the holiday season has kicked off. But the increase is so far remarkably modest.

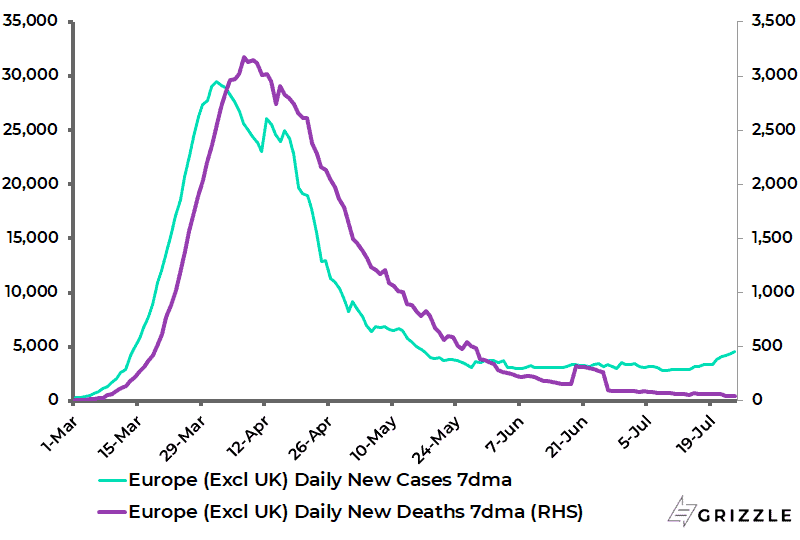

Average daily new cases in Europe, excluding UK, have risen by 63% from a low of 2,825 in early July to 4,614 over the past week, but remain 84% below the peak of 29,526 reached in April. While average daily deaths in Europe are now down 99% from the April peak (see following chart).

Europe (ex-UK) Covid-19 daily new cases and deaths (7-day moving average)

Note: Europe excl. UK includes Italy, Spain, Germany, France, Switzerland, Netherlands, Austria, Belgium, Norway, Sweden, Denmark, Portugal, Ireland, Luxembourg, Finland and Greece. Source: Johns Hopkins University

An Acceleration of COVID Wave 2 in America is Bullish for Bonds the Dollar

For such reasons, the base case remains that the markets have more to fear in the third quarter from a sudden realisation that the Fed may be too easy, in the context of growing V-shaped recovery hopes as the virus is seen to be burning itself out, than from a deflationary implosion.

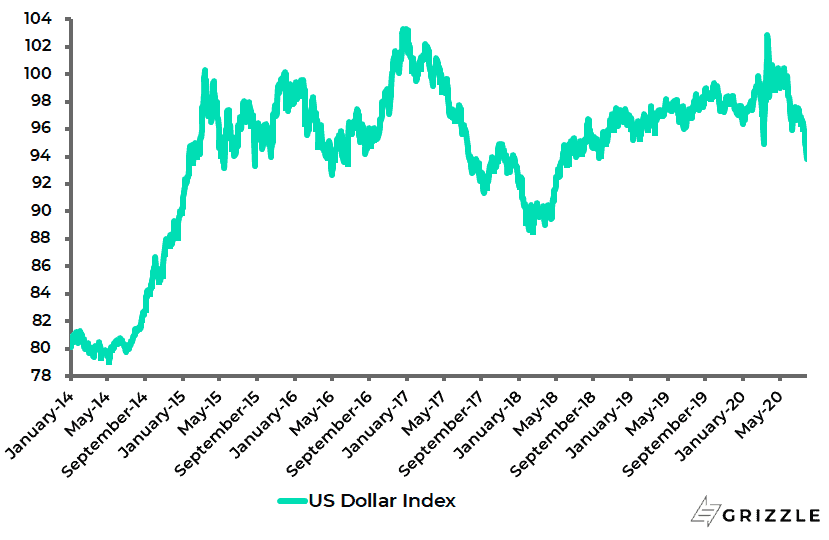

Still, what if this base case is wrong and the second wave accelerates in America in a way that causes investors to question the re-opening narrative? This is likely to be signaled by a renewed rally in the US Treasury bond market and a resurgent US dollar, whereas of late the dollar has continued to weaken with the US dollar index declining by 8.3% since 20 March (see following chart).

US Dollar Index

Source: Bloomberg

That will be the moment for Federal Reserve chairman Jerome Powell to show if he has the mettle to avoid negative interests. This is because in such a risk off move, the money markets are likely to start pricing negative rates in the US.

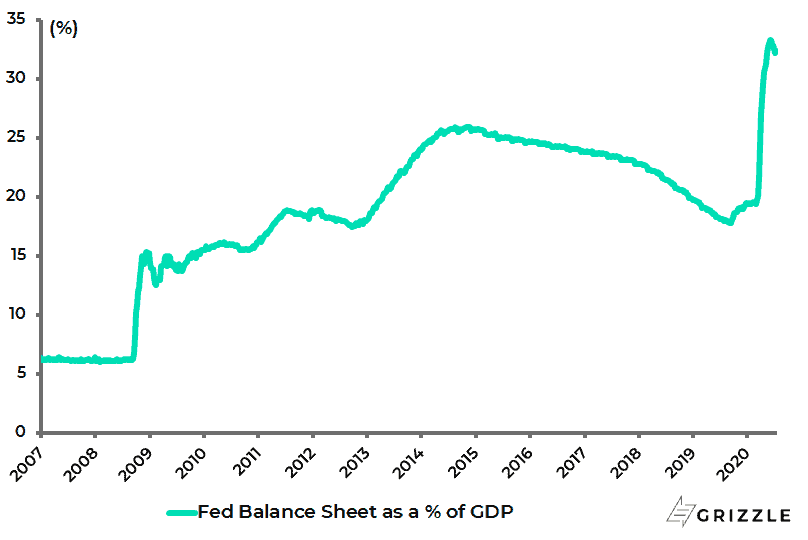

Still, one point is clear. Powell would react to such negative developments with a stated willingness to buy yet more assets via a further expansion of the Fed balance sheet which is already running at 32% of GDP (see chart below).

Federal Reserve balance sheet as % of US GDP

Source: Federal Reserve

This would provide another catalyst to buy equities even though, by then, the American stock market will have started to worry about the policy implications of a Democratic Presidency, which is the likely outcome if the virus interrupts the re-opening narrative that is the Donald’s best hope of getting re-elected.

The Regulation & Taxation of Big Tech is the Biggest Risk to the Market

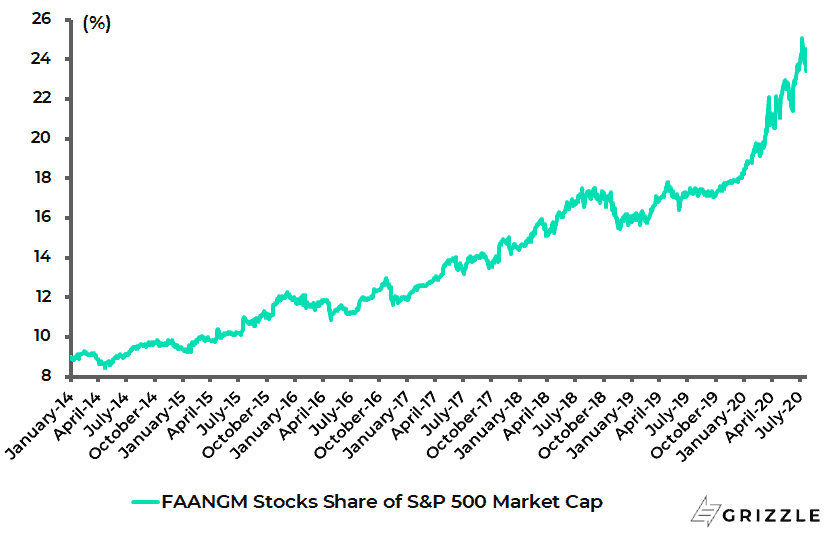

In this respect, the biggest risk for the American stock market is a Democratic platform targeting regulation and taxation of so-called Big Tech. Facebook, Apple, Microsoft, Amazon, Google and Netflix now account for 24% of the S&P500 market capitalisation, up from 18% at the start of this year (see following chart).

US Big Tech stocks’ share of S&P500 market cap

Note: FAANGM = Facebook, Apple, Amazon, Netflix, Alphabet (Google), Microsoft. Source: Bloomberg

It is Time for Silver to Play Catch Up with Gold

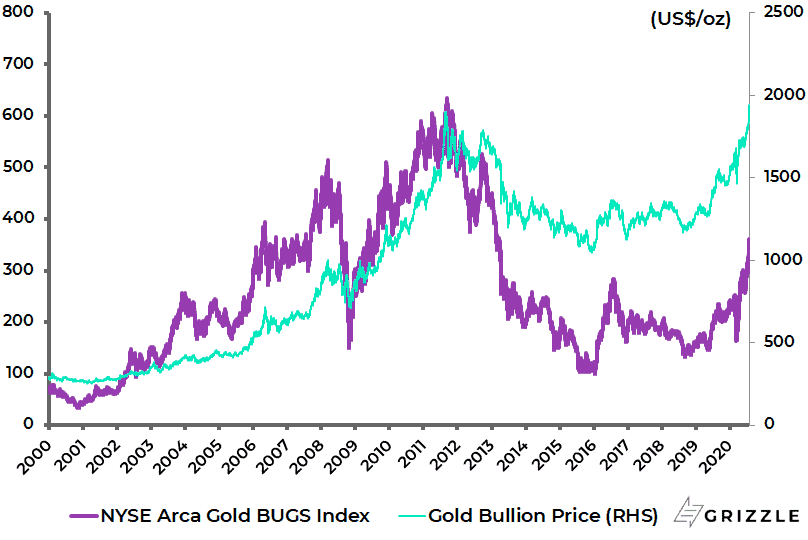

Meanwhile, all of the above is a reason to maintain holdings in gold and gold mining stocks as a hedge despite their already impressive performance year to date.

The gold bullion price has risen by 25.4% so far in 2020 to US$1,902/oz (as of July 24/2020), or only 1% below the all-time high of US$1921/oz reached in 2011, while the gold-mining stocks index is up 41.2% year-to-date (see following chart).

Given what the G7 central banks have been up to in the past more than four months, gold mining stocks should by now be a core holding of all global equity portfolios.

Gold Bullion Price and NYSE Arca Gold BUGS Index

Source: Bloomberg

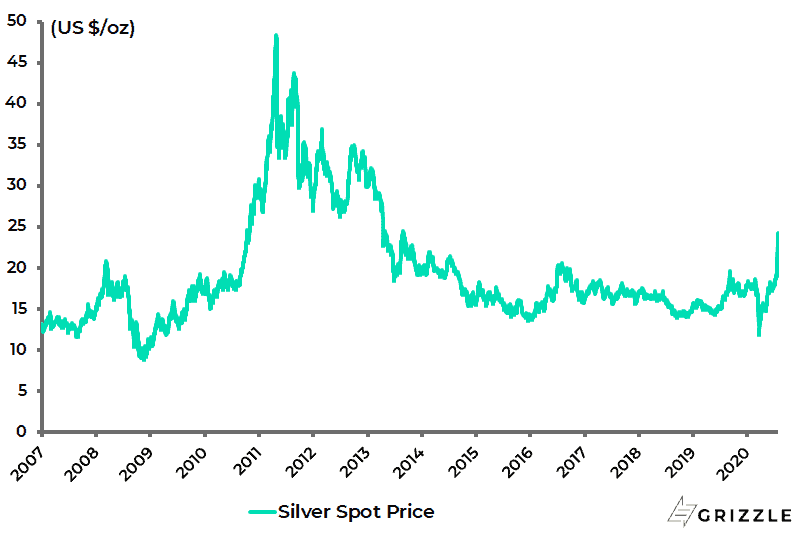

In a further confirmation of the bull market in precious metals, silver broke out technically this week above its 2016 high of US$21.14/oz. The silver spot price surged to an intraday high of US$23.27/oz on 23 July, the highest level since September 2013, and is now US$22.77/oz, though it is still 54% below the peak of US$49.8/oz reached in 2011 (see following chart). It is now time for silver to play catch up with gold.

Silver spot price

Source: Bloomberg

It should be made clear again that the feared second wave is not the base case here.

Still, being neither a doctor nor an epidemiologist, it makes no sense to be too dogmatic on this issue.

It also remains the case, from an investment standpoint, that this is a most unusual economic downturn since it is neither driven by inflationary overheating nor by a deflationary banking crisis, but rather by a decision by panicking governments, unprecedented in human history, to lock down whole economies for a virus where the death rate is running at around 5% of confirmed cases in the developed world and 3% in the developing world and where the average age of those dying is around 80.

Clearly, on a cost benefit analysis, these lockdowns make no sense, which is one good reason why such across-the-board lockdowns will not happen again. The more likely reaction, as is now being seen, is localized lockdowns in response to localized outbreaks.

About Author

The views expressed in Chris Wood’s column on Grizzle reflect Chris Wood’s personal opinion only, and they have not been reviewed or endorsed by Jefferies. The information in the column has not been reviewed or verified by Jefferies. None of Jefferies, its affiliates or employees, directors or officers shall have any liability whatsoever in connection with the content published on this website.

The opinions provided in this article are those of the author and do not constitute investment advice. Readers should assume that the author and/or employees of Grizzle hold positions in the company or companies mentioned in the article. For more information, please see our Content Disclaimer.