Tobacco company Altria (NYSE:MO) announced results that exactly met expectations but is still struggling to find growth.

Revenue came in at $4.80 billion, a 2% miss to consensus of $4.89 billion while earnings per share of $1.02 met the consensus estimate of $1.02 exactly. and was up 5% from the same quarter in 2018, in-line with management guidance.

Altria wrote off another $4.1 billion of its investment in JUUL for a total write-off of $8.6 billion or 70% of the money it originally put into JUUL last year.

$8.6 billion of losses is equivalent to one and a half years of dividend payments down the toilet.

So even though adjusted earnings met expectations it comes as cold comfort to investors as Altria is still a sagging business in a declining industry.

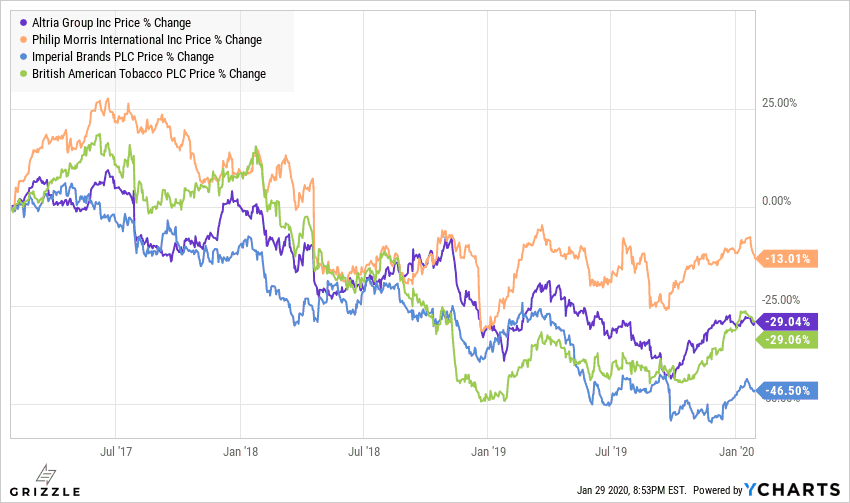

Recent cost-cutting measures will help prop up earnings and the dividend as revenue growth stagnates, but the stock prices of all tobacco companies have sorely underperformed the general market over the last three years.

Altria is better positioned than most with a potentially lucrative investment in cannabis still to pay off, but meaningful results from that business are still a few years away.

The Juul business that once seemed so promising has totally stagnated leaving the company once again struggling to find a new source of growth.

Altria Down 30% in the Last Three Years

Source: YCharts

Investors have historically been well rewarded by tobacco companies with juicy dividend payments and rising stock prices, however, the good times look to be over.

Tobacco companies historically maintained their price-to-earnings ratios in the market which meant as they increased dividend rates, the stock price increased to keep the yield constant.

Falling interest rates also helped as investors bid up the shares driving the yield down in line with the lower interest rates paid on bonds.

With companies payout out almost 100% of free cash flow in the form of dividends there is very little cashflow left to harvest.

In other words, the dividend can’t increase much further if the companies don’t start growing again and this is easier said than done in a dying industry.

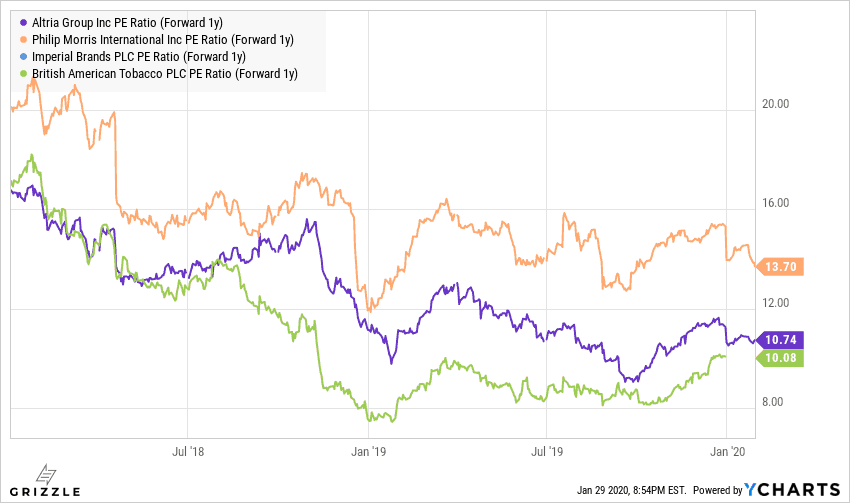

It doesn’t help that investors have been pushing the P/E ratio down in the past 3 years which is contributing to lower share prices.

P/E Ratio on the Decline for All Tobacco Stocks

Source: YCharts

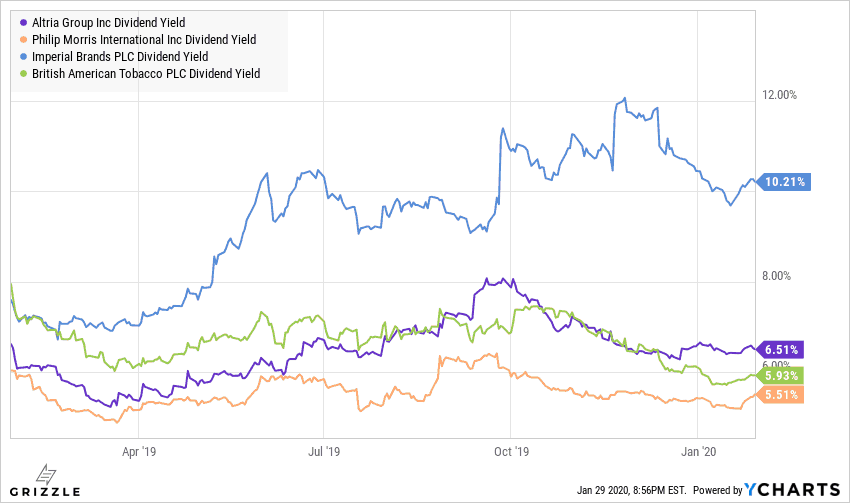

So while the dividend yields of Altria and others may look juicy compared to a bond yielding less than 1%, stock prices have been falling enough to offset the yield, leaving investors sitting on negative returns.

Tobacco companies will be hard-pressed to grow their dividends at the current rate for much longer without reigniting growth.

Dividend Yield

Source: YCharts

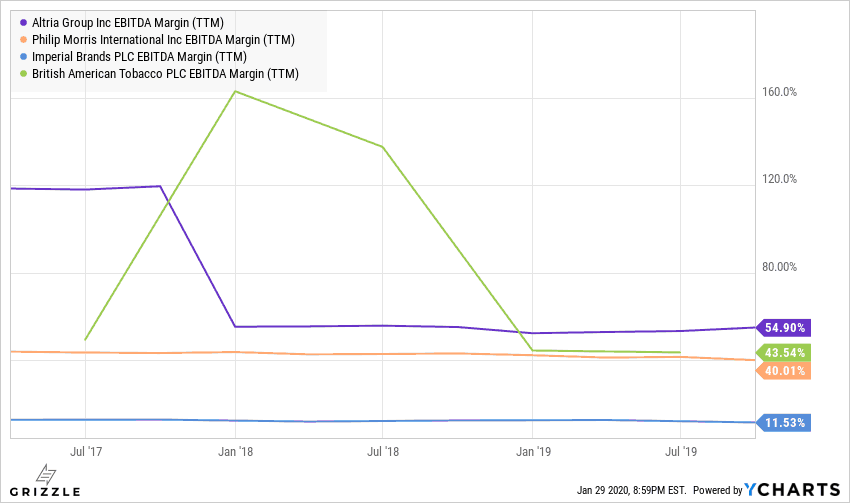

Altria is the best positioned of the bunch with superior margins which have translated into peer leading dividends and buybacks.

Altria Margins are Leading the Group

Source: YCharts

Debt levels for all the tobacco companies are on the rise.

The fact that debt is rising for Altria tells us the company is both trying to buy growing businesses and also borrowing to keep up the dividend growth the company is known for.

They still have more room to issue more debt over time, but this is still just another indicator that dividend growth can’t go on forever without top- and bottom-line growth.

Debt to Cashflow Lowest in the Group but Rising

Source: YCharts

About Author

The opinions provided in this article are those of the author and do not constitute investment advice. Readers should assume that the author and/or employees of Grizzle hold positions in the company or companies mentioned in the article. For more information, please see our Content Disclaimer.