Geopolitics is back driving the newsflow with events in the Middle East.

Meanwhile, there is also the emerging force of the BRICS.

The chief outcome of the meeting of the BRICS countries in Johannesburg in August was the announcement that Saudi Arabia and the UAE, among other countries, have been invited to join the grouping.

South African President Cyril Ramaphosa announced after the summit that the BRICS members have decided to invite Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates to become full members of BRICS, effective from 1 January 2024.

Saudi Foreign Minister Prince Faisal bin Farhan has said that the kingdom will study the details and take “the appropriate decision” and that BRICS was “a beneficial and important channel” to strengthen economic cooperation.

UAE President Mohamed Bin Zayed also praised the group’s decision to include his country in BRICS.

Such an outcome would mean that the BRICS grouping would control 40% of world oil exports at a time when the overwhelming probability is that US shale oil production has peaked, as discussed here previously (see “Inflation Could Be The Casualty Of OPEC’s Return To Oil Market Dominance”, 10 October 2023).

This is, potentially, a momentous development.

The current BRICS members accounted for 14.2% of world total crude oil exports in 2022, while the newly invited BRICS members accounted for a further 25.4% of the total.

Within the new BRICS countries, Saudi, UAE, and Iran accounted for 16.9%, 6.2%, and 2.1%, respectively, of world crude oil exports.

For the current members, Russia and Brazil accounted for 11% and 3.1%.

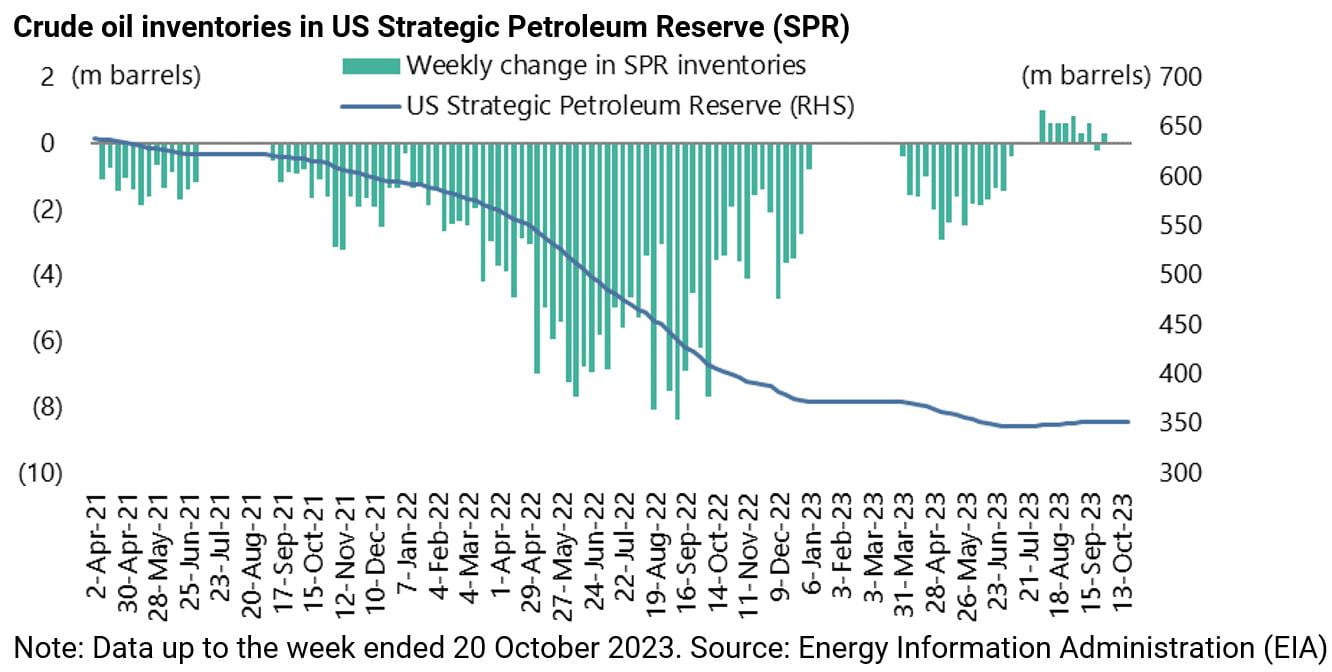

Meanwhile, in terms of the near-term issues for the oil market, the Biden administration has since last quarter stopped draining the Strategic Petroleum Reserve (SPR).

This writer continues to believe that this was the main reason for oil price weakness in the first half of this year.

Crude oil inventories in the SPR increased by 4.12m barrels last quarter to 351.28m barrels at the end of September, after declining by 24.02m barrels in 2Q23.

They declined by only 6,000 barrels in the first week of October and have since been flat at 351.27m barrels.

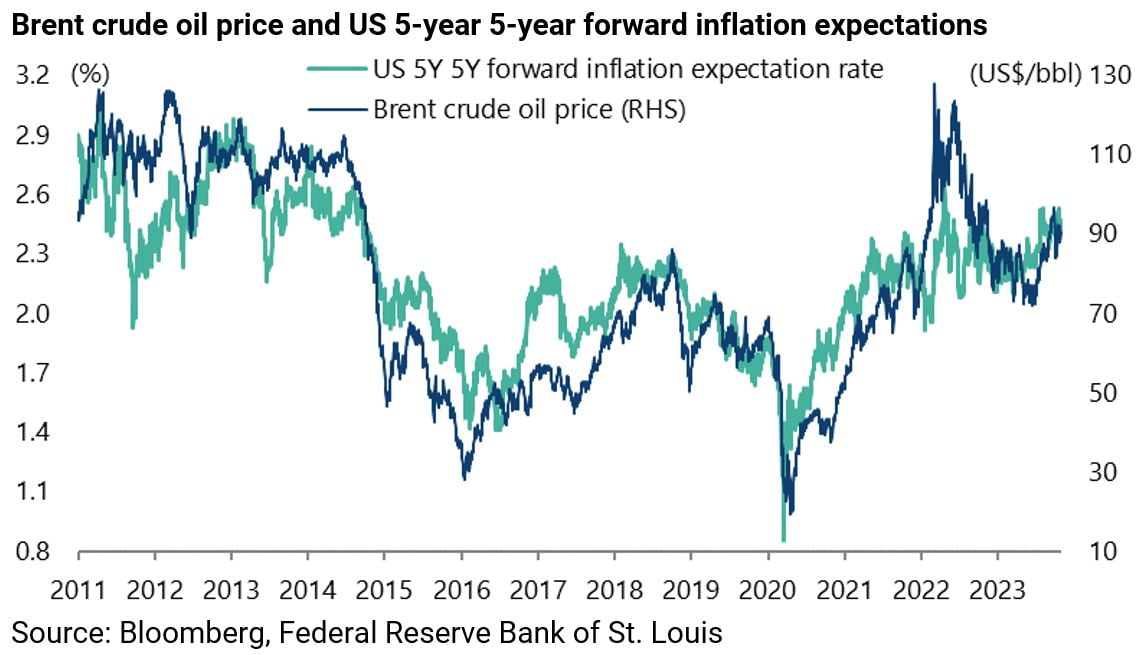

The oil price remains highly relevant for the Fed because of its potential to disrupt inflation expectations.

The Brent crude oil price has risen by 26.4% from a recent low reached in late June, while the US five-year five-year forward inflation expectations rate rose from 2.23% in late June to 2.53% on 18 October, the highest level since April 2022, though it has since declined to 2.45%.

The correlation between the Brent crude oil price and the five-year five-year forward inflation expectations rate has been 0.88 since 2011.

Meanwhile, the ten-year Treasury bond yield is now 4.87%.

Rising Rates are Putting Mortgage Activity on Ice

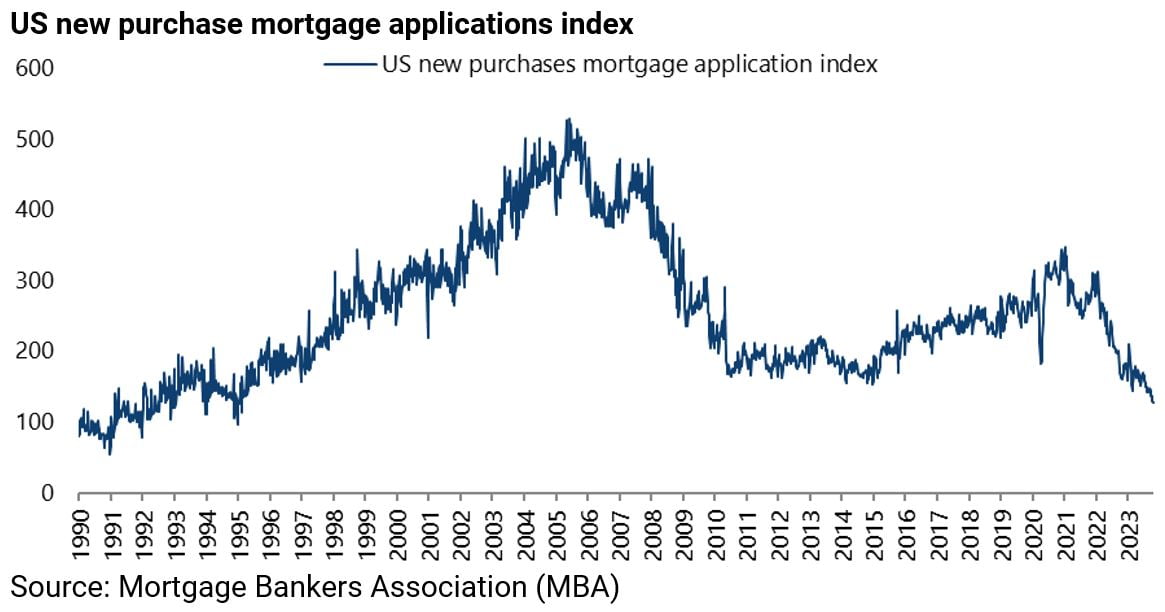

This is not good for the housing market where the average 30-year fixed-rate mortgage rate reached 7.9% on 20 October, the highest level since September 2000, according to the Mortgage Bankers Association.

Mortgage applications for home purchases have also fallen to the lowest level since February 1995, with the new purchase mortgage applications index declining by 21% year-to-date to 127 in the week ended 20 October.

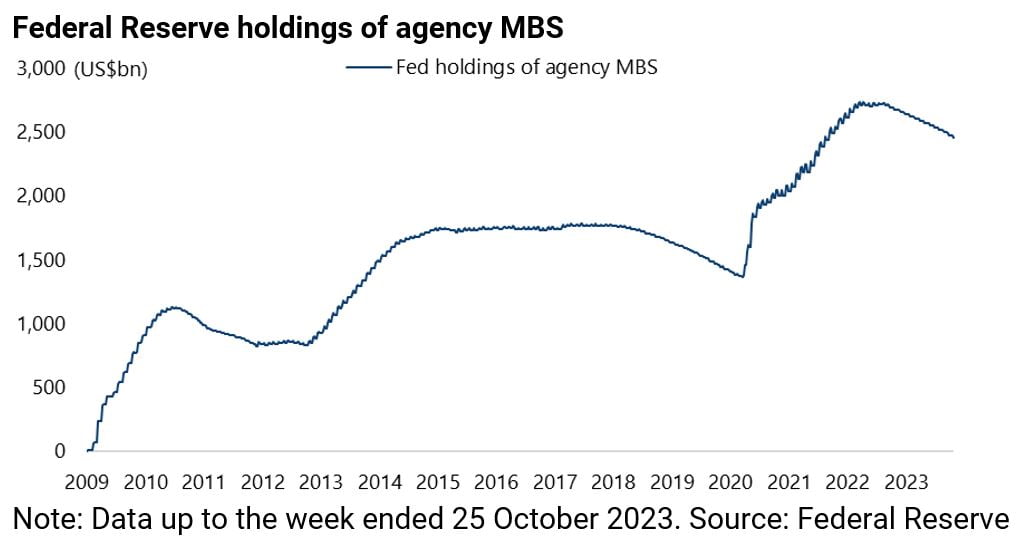

A further pressure on the mortgage market is that the Fed is now selling mortgage-backed securities, not buying them.

Fed holdings of agency MBS peaked at US$2.74tn in mid-April 2022 and have since declined by US$277bn or 10% to US$2.46tn on 25 October.

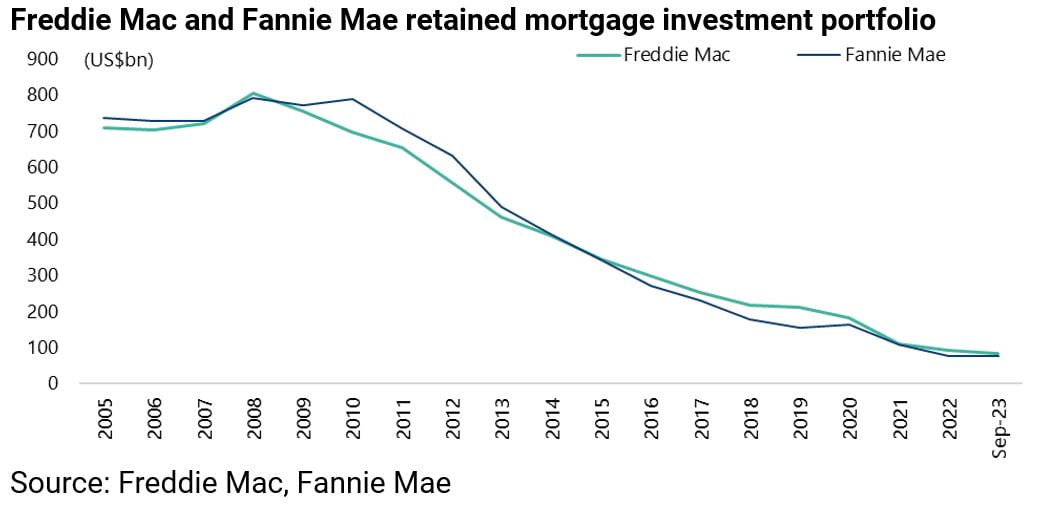

As for the former mortgage giants Freddie Mac and Fannie Mae, Freddie Mac’s retained mortgage investment portfolio totaled only US$85.1bn at the end of September, compared with US$182bn at the end of 2020 and a peak of US$805bn at the end of 2008.

Similarly, Fannie Mae’s retained mortgage investment portfolio totaled only US$76bn at the end of September, down from US$163bn at the end of 2020 and US$792bn at the end of 2008.

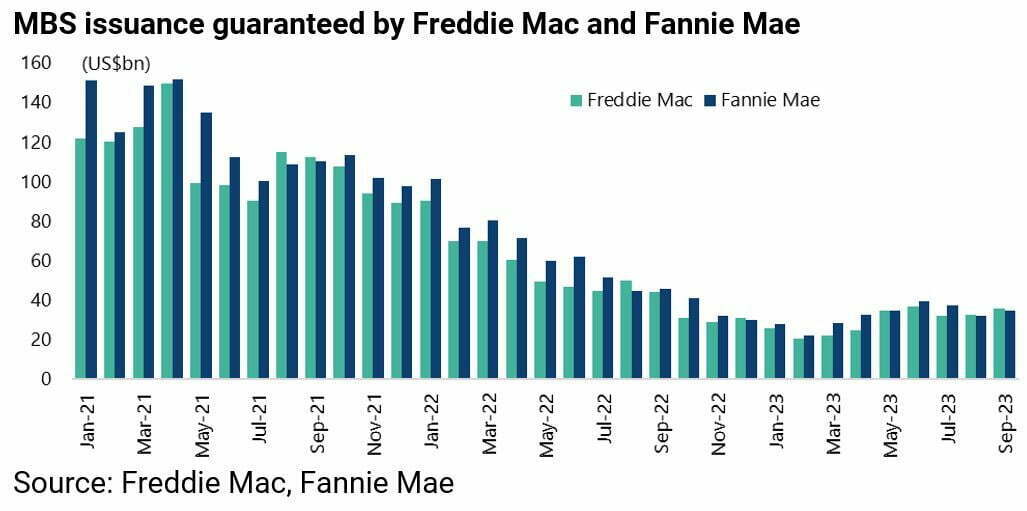

Freddie Mac has guaranteed “only” US$265bn of MBS in the first nine months of this year, down 50% YoY from US$525bn in January-September 2022.

Fannie Mae has guaranteed US$289bn in January-September, down 51% YoY from US$594bn in the same period in 2022.

All this means that, with the Fed’s bid gone from the market, MBS production has declined to about 50% of last year’s level. The result is the highest spread over Treasuries in 30 years.

For example, the spread between the 30-year fixed rate mortgage rate and the 10-year Treasury zero coupon bond yield rose to 321bp in mid-July, the highest level since the data series began in 1990, and is now 281bps.

Companies are Sitting Pretty While the Government Stares at a Bond Maturity Wall

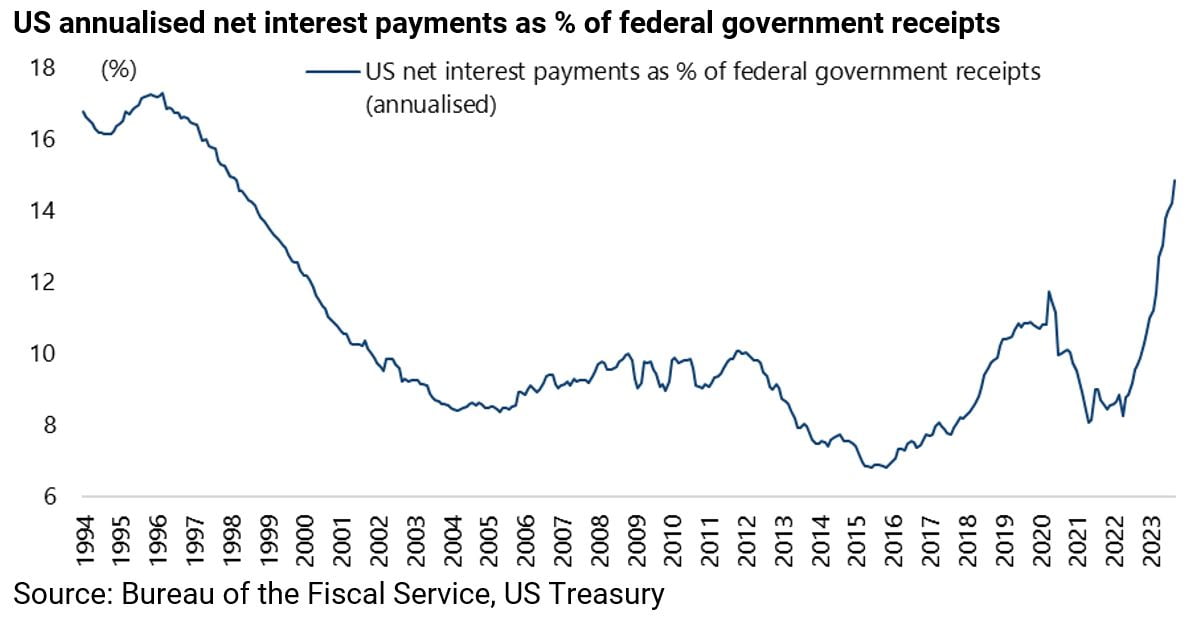

Meanwhile there continues to be growing talk that the Treasury bond market has begun to reflect supply concerns, in terms of the growing debt servicing cost of financing America’s enormous fiscal deficits as a result of the rise in bond yields.

Annualised net interest payments as a percentage of federal government revenues have risen from 8.3% in April 2022 to 14.8% in September, the highest level since March 1998.

It is certainly the case that the recent Fitch downgrade of America’s sovereign credit rating has caused renewed focus on this issue, as previously discussed here (see “Where To Hide If The US Government Bond Selloff Continues”, 18 October 2023).

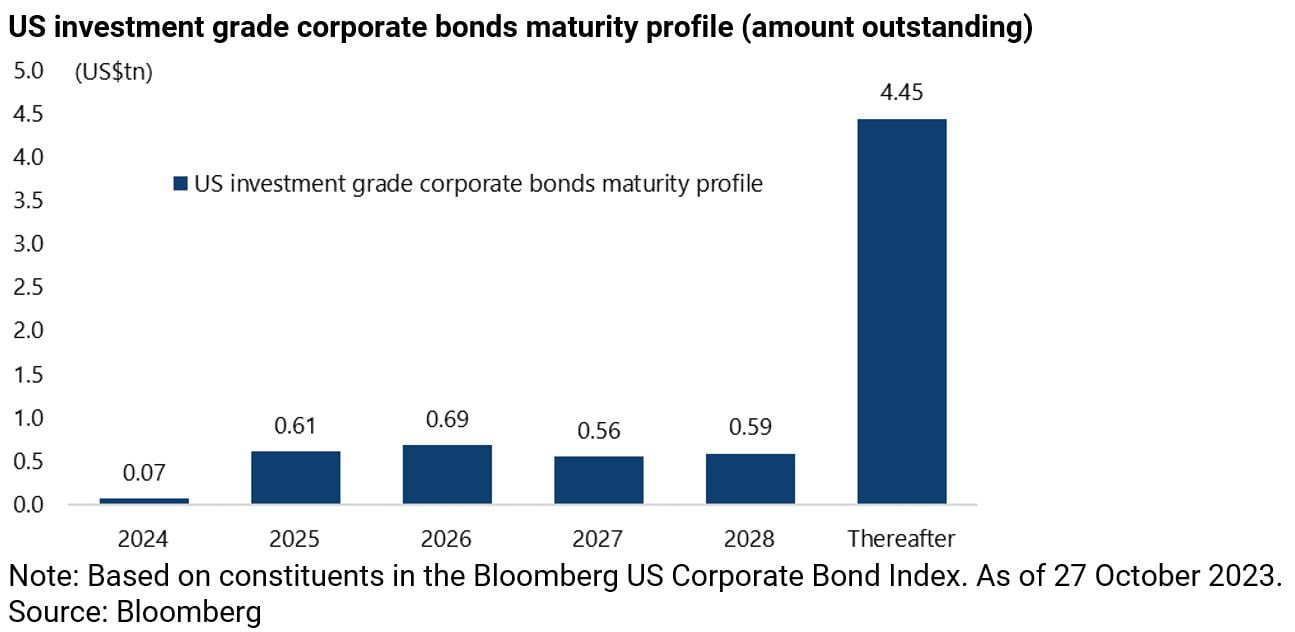

It is also the case that America’s corporate sector appears to have done a much better job locking in low bond yields, by terming out debt in recent years, than the US Treasury.

While US$2.5tn of US investment-grade corporate bonds are due to mature in the next five years, another US$4.45tn will only mature after 2028.

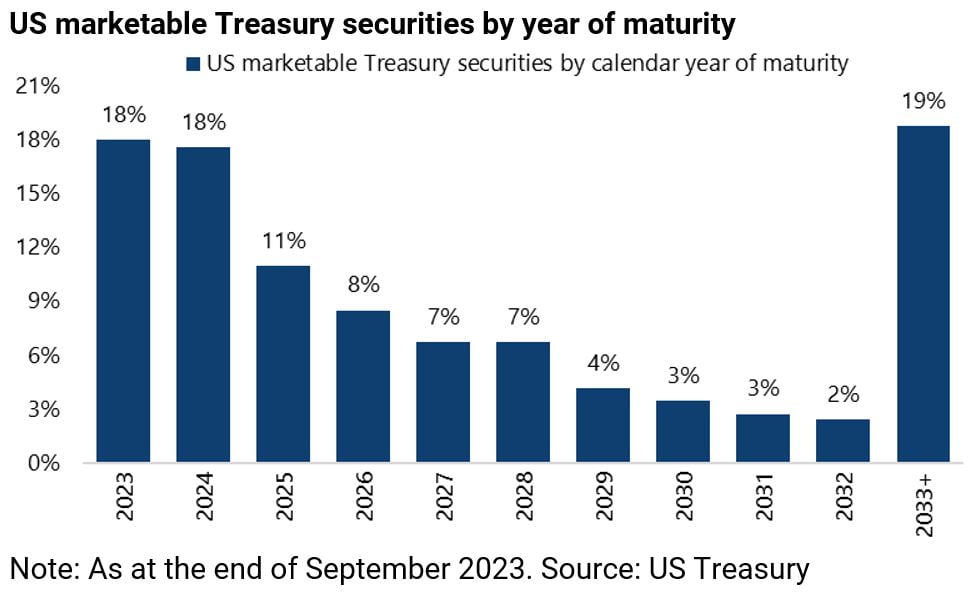

As for Treasury securities, 47% of US marketable Treasury securities will mature before the end of 2025 with 53% maturing within the next three years.

Foreign Selling of Treasury Bonds Not Helping Yields, Even with Stepped up Domestic Purchases

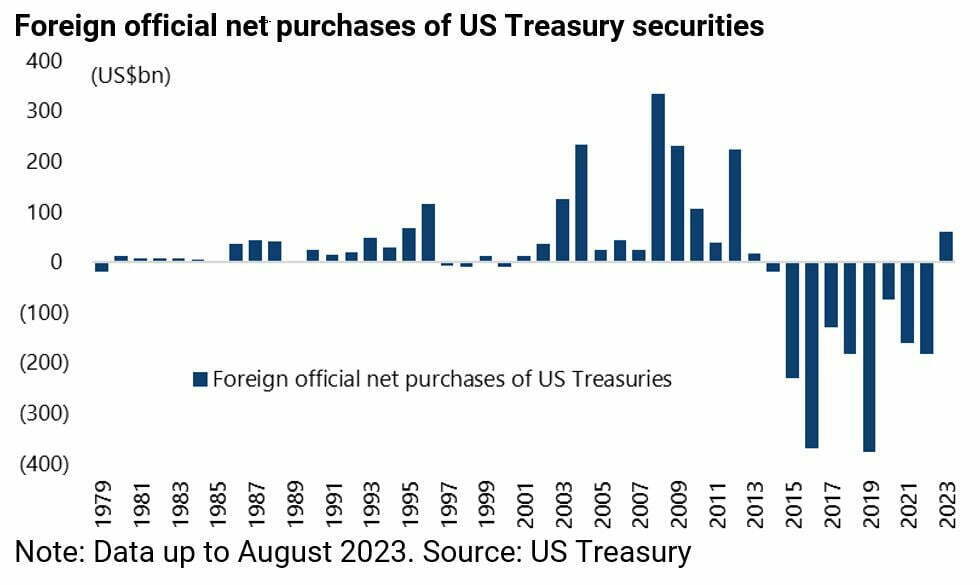

The other point is that major foreign holders of Treasuries have continued to sell.

Foreign central banks became significant net sellers of Treasury securities in 2014 for the first time since the 1970s and have continued to sell until this year.

They sold a net US$18bn of Treasuries in 2014 and a net US$1.66tn since then, though they have bought a net US$62bn in the first eight months of 2023.

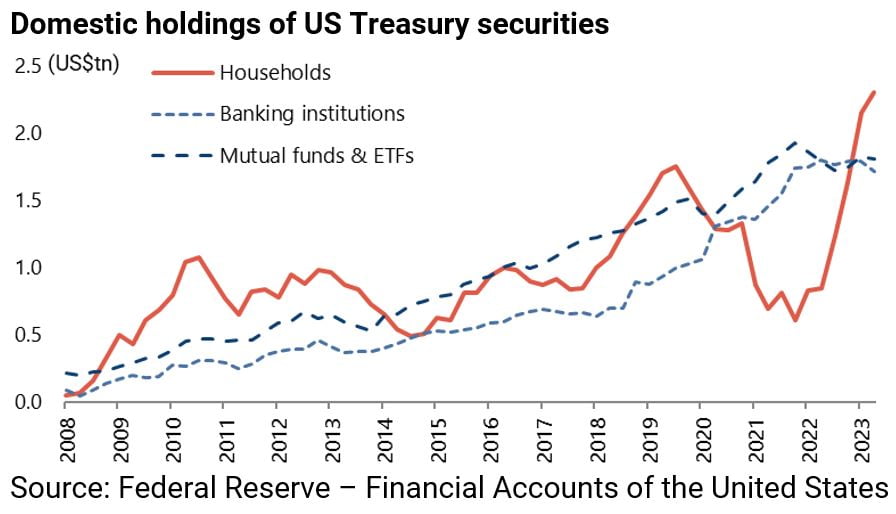

The foreign selling has been offset by increased domestic purchases of Treasuries.

US households’ holdings of Treasury securities have surged from US$611bn at the end of 2021 to a record US$2.31tn at the end of 2Q23, according to the Fed’s flow of funds data.

Banking institutions’ holdings of Treasuries also increased, from US$993bn in 3Q19 to US$1.72tn in 2Q23, while mutual funds’ and ETFs’ holdings increased from US$1.39tn in 2Q20 to US$1.93tn in 4Q21 and were US$1.81tn in 2Q23.

Meanwhile, foreign ownership of US Treasury securities in aggregate has declined from 43.7% in 2Q14 to 30.1% in 2Q23.

This is why the employment data remains more important in the near term than the inflation data.

Meanwhile, the anticipated Fed fudge, if it happens, will increase the chances dramatically that the US Treasury bond market will be vulnerable to a supply-related sell-off.

This is because the Fed’s credibility will be questioned while there will, at that point, be mounting market focus on the debt servicing costs of running America’s huge fiscal deficits at a time when it is extremely unlikely that there will be the political will to cut spending whichever party is in power.

This is the context where it becomes much more likely that Washington will resort to Japanese-style yield curve control as long discussed here (see “The Bond Market vs Yield Curve Control: Who Blinks First”, 18 February 2021).

About Author

The views expressed in Chris Wood’s column on Grizzle reflect Chris Wood’s personal opinion only, and they have not been reviewed or endorsed by Jefferies. The information in the column has not been reviewed or verified by Jefferies. None of Jefferies, its affiliates or employees, directors or officers shall have any liability whatsoever in connection with the content published on this website.

The opinions provided in this article are those of the author and do not constitute investment advice. Readers should assume that the author and/or employees of Grizzle hold positions in the company or companies mentioned in the article. For more information, please see our Content Disclaimer.