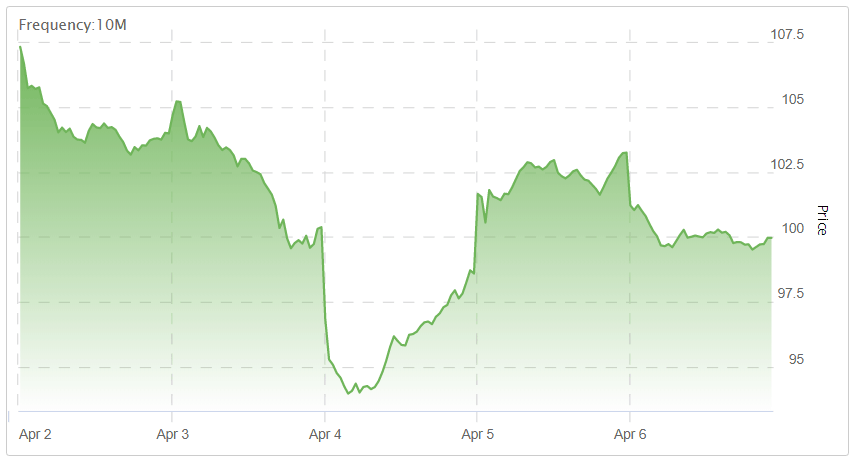

Another Tough Week for Global Marijuana Stocks — Down 7%

Canadian marijuana stocks are now down 10% since the March 30 release of a Barron’s article pointing to a potential supply glut, compared to a decline of only 2% for the S&P 500. Stocks are down a full 40% since reaching what is likely to be their all-time high in January when investor optimism peaked.

Marijuana stocks have been in the doldrums since their January highs and neither recent capacity expansion announcements nor positive momentum on the Canada legalization bill have been able to push the stocks higher.

As we have been saying here at Grizzle we think retail prices will only hold up through the end of the year at most, so if the stocks can’t outperform while legal pricing is getting better we see risks to stock prices once producer capacity really ramps up in 2019 and prices fall.

WEEKLY PERFORMANCE OF THE TOP 75 GLOBAL MARIJUANA COMPANIES

New Cannabis Ventures

2 Studies Link Medical Marijuana Legalization With Lower Rates of Opioid Prescriptions

A study by professors at Emory University and University of Kentucky found that when a state legalized medical marijuana, government healthcare plans prescribed up to 6 percent less painkillers.

In the second study, professors from the University of Georgia found that legal states saw an 8.5 percent reduction in daily opioid doses filled for citizens with government sponsored healthcare.

If the state allowed medical dispensaries the decrease was even higher at 15% less painkillers prescribed compared to non-legal states.

The authors of both studies argued that these findings support the use of medical marijuana as a policy tool to help wean the US off its addiction to prescription pain medicine. Americans enrolled in government health plans have been shown to be at much higher risk of suffering from chronic pain, and opioid abuse and overdose than the general population.

What This Mean for Canada

As more and more studies support marijuana as an effective medicine for pain, demand for marijuana infused pharmaceuticals should increase, benefiting legal producer revenue and volumes. Pharmaceutical demand could be multiples of recreational demand and is a big part of the story supporting the rich stock valuations.

Painkiller Sales in the US

Grand View Research

Marijuana Pain Medicine Won’t Replace Opioids any Time Soon Without Dramatic Decreases in Production Costs

Prescription pain medicine sells for $15 per gram of active ingredient, while CBD, the pain killing active ingredient in marijuana costs $18 per gram just to produce and sells for over $100.

Production costs likely need to fall at least 50% to make it profitable for CBD medicine to compete against opioids.

Greece is Ramping up to Become a Big Player in the Global Marijuana Export Game

Canadian producer Aphria is rumoured to be in talks with the government to invest up to 1 billion euros on a large parcel of land. Another investment consortium, named Golden Greece, has the government’s backing to invest 400 million euros in 2018 and another 1.1 billion euros over time.

What This Means for Canada

More and more countries are ramping up their own domestic marijuana production capacity. Competition is increasing for Canadian exporters as they court customers in Europe, Australia or elsewhere.

Building greenhouses outside Canada is a good thing for producers like Canopy Growth or Aphria, but it also means there will be less demand for marijuana from Canada.

Grizzle expects Canada will be oversupplied by up to 850,000 kg by 2021, and if this excess can’t be exported it means much lower retail prices and lower revenue for legal producer stocks.

READ THE MARIJUANA EXPORT MIRAGE FOR AN IN-DEPTH MARIJUANA INVESTING REPORT ON THE STATE OF DEMAND FOR MEDICAL MARIJUANA OUTSIDE OF CANADA

About Author

The opinions provided in this article are those of the author and do not constitute investment advice. Readers should assume that the author and/or employees of Grizzle hold positions in the company or companies mentioned in the article. For more information, please see our Content Disclaimer.